Unlock the Secrets of Your Purchase Receipt Today

Imagine this: you just finished a shopping spree, and your bag is filled with your latest purchases, alongside a pile of receipts. You might think of these receipts as mere pieces of paper to clutter your wallet or get lost in your car. But there's more to those small, often-ignored pieces of paper than you might initially recognize. Today, we're going to unlock the secrets hidden within your purchase receipts, turning them from a bother into an invaluable resource for managing your finances and tracking your expenses.

Why You Should Care About Your Receipts

Receipts are not just proofs of your purchases; they are also keys to unlocking various financial benefits and organizational tools. Here are several reasons why you should care:

- Warranty Tracking: Receipts contain the necessary details to file claims for replacements or repairs under warranty.

- Returns and Exchanges: Most stores require the original receipt for any returns or exchanges.

- Tax Deductions: Certain expenses can be written off on your taxes. Having receipts is crucial for substantiation.

- Budgeting and Expense Tracking: Understand where your money is going by categorizing and reviewing your expenditures.

How to Organize Your Receipts

Organizing receipts can feel overwhelming, but with a systematic approach, it becomes manageable:

Physical Organization

- Folders by Category: Have folders for different categories like groceries, utilities, clothes, etc.

- Date Binder: Use a binder with tabs for each month or week where you can file receipts chronologically.

- Envelope System: An envelope per store or shopping trip can help keep receipts together by location.

Digital Organization

- Scanning Apps: Apps like Evernote, Microsoft OneNote, or dedicated receipt scanning apps can digitize your receipts.

- Spreadsheets: Manually input details into a spreadsheet or use receipt scanning services that integrate with spreadsheets.

- Financial Software: Many accounting software options have features to scan and organize receipts directly.

📌 Note: Always ensure digital copies are securely backed up to prevent loss of valuable data.

Decoding Your Receipt

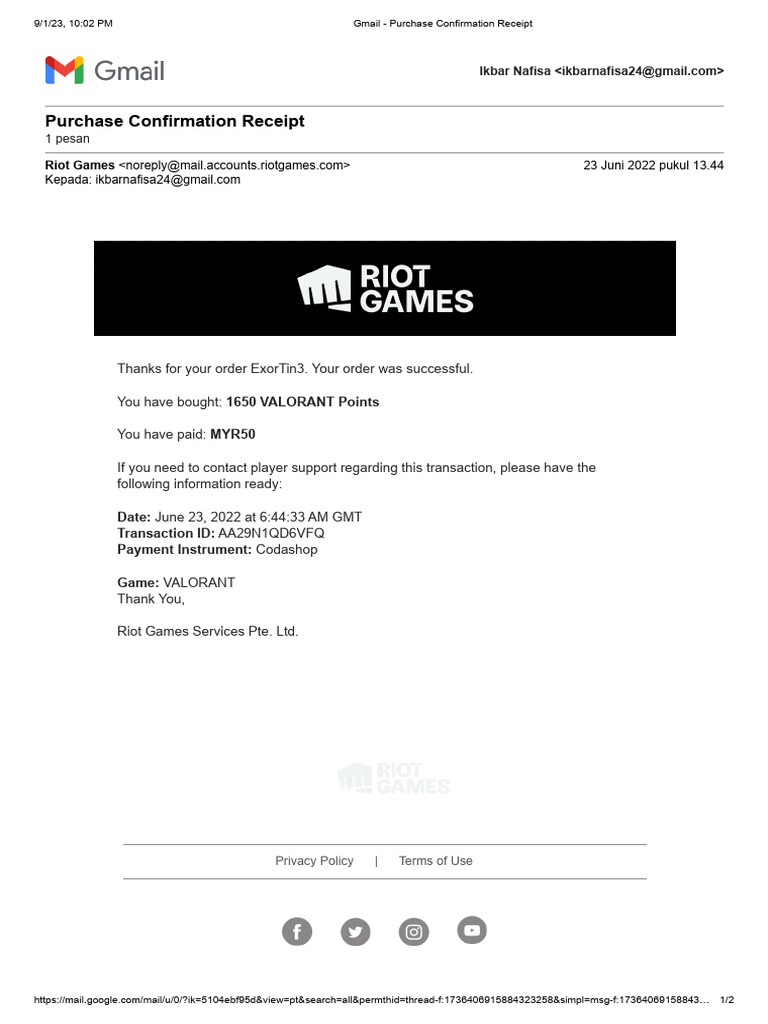

Have you ever glanced at a receipt and wondered what all those codes and numbers mean? Here's a quick guide:

| Description | What it Means |

|---|---|

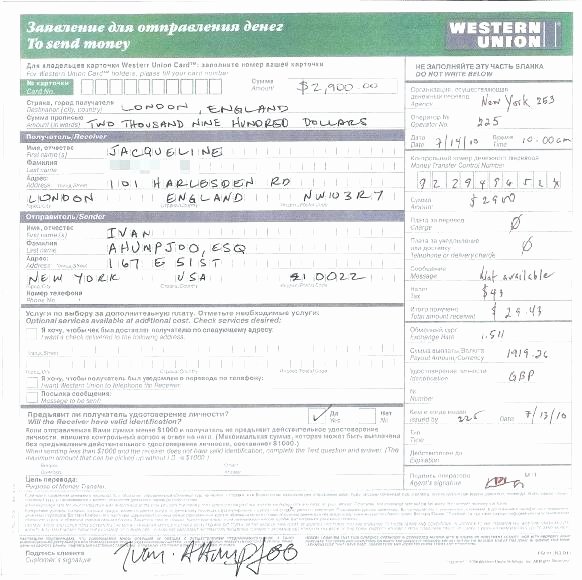

| Transaction Number | A unique identifier for the purchase, useful for customer service issues. |

| Item Code | Codes that correspond to products in the store's inventory. |

| Price | The actual price paid for each item. |

| Date and Time | When the transaction occurred, vital for warranty claims. |

| Store Information | Name, address, and contact details of the store. |

Leveraging Receipts for Money-Saving Strategies

Receipts aren't just for record-keeping; they can be powerful tools for saving money:

Cashback and Rewards Programs

- Many stores offer cashback or points for every purchase, often requiring you to submit receipts.

Tracking Sales and Discounts

- Keep track of items purchased at sale prices to compare with regular prices and ensure you're getting the best deals.

Price Adjustments

- Some retailers provide price adjustments if items go on sale shortly after you've purchased them. Your receipt proves the original price.

🚩 Note: Always check the store's policy on price adjustments to take advantage of this saving opportunity.

Expense Reimbursement

- Business owners, employees, or freelancers often need to claim expenses. Receipts make this process straightforward.

Your Receipts and Privacy

Here's something often overlooked: every receipt contains personal information. Here’s how to handle privacy concerns:

- Shredding: Physically destroy receipts if they have personal details like credit card numbers.

- Digital Protection: Secure digital records with encryption or password protection.

- Be Mindful of Prints: Thermal paper receipts can be harmful to your health due to the chemicals they contain; avoid licking your fingers when handling them.

Using Receipts in Daily Life

Beyond the obvious financial benefits, here are ways to incorporate receipts into daily life:

Return Reminders

- Set reminders on your phone for return or warranty expiration dates based on your receipt information.

Receipts as Shopping Diaries

- Your receipts can provide a chronological diary of your purchases, helping to recall when and where you bought things.

Reusing Paper

- Blank or backside of receipts can be used for note-taking, to-do lists, or as bookmarks.

In the age of digital transactions, your receipts still hold immense value, not just for the immediate benefits like returns or expense tracking but for long-term financial management and savings. By organizing your receipts effectively, you're setting yourself up for better budgeting, cost-saving strategies, and a clearer understanding of your spending patterns. Remember, each receipt tells a story of your consumer journey, from where you've been to where you're financially headed. So next time you're tempted to toss away that receipt, think again. It's a small piece of paper with the potential to be a big asset.

How long should I keep my receipts?

+

General advice is to keep receipts for at least 30 days after purchase for returns, or longer if the items have warranties. For tax purposes, keep receipts for 3 to 7 years, depending on your local tax authority’s regulations.

Can I get a refund without a receipt?

+

It depends on the store’s policy. Some offer store credit or return without a receipt, but the process can be more complicated, often requiring proof of purchase like a bank statement or a receipt image from an app.

Is there any software recommended for receipt management?

+

Yes, many software solutions are available. Popular ones include Expensify, Shoeboxed, and Receipt Bank, which help in digitizing, categorizing, and storing receipts.

Are electronic receipts as valid as paper ones?

+

Legally, electronic receipts are generally considered just as valid as paper receipts when they contain the same information and follow a store’s electronic receipt policy.

How can I use receipts to monitor my spending habits?

+

You can categorize your receipts by expense type, track the frequency of purchases, and analyze the data to identify trends in your spending. This can help you make more informed decisions about where to cut back or where to invest more financially.