How to Match Bank Statements with Cash Receipts

Reconciling your bank statements with your cash receipts is an essential part of maintaining accurate financial records. This process helps you identify discrepancies, ensure that all transactions are accounted for, and maintain the integrity of your financial reporting. Here's how you can streamline this crucial task.

The Importance of Financial Reconciliation

Before diving into the steps, it’s key to understand why this process is so important:

- Fraud Detection: Regular reconciliation helps you spot any unauthorized or fraudulent transactions.

- Accuracy: Ensures your records reflect the true financial position of your business.

- Compliance: Many regulatory frameworks require businesses to keep accurate records for tax and legal purposes.

- Cash Flow Management: Understanding your cash flow can help in making informed business decisions.

Preparatory Steps

Here are the steps you should take before starting the reconciliation:

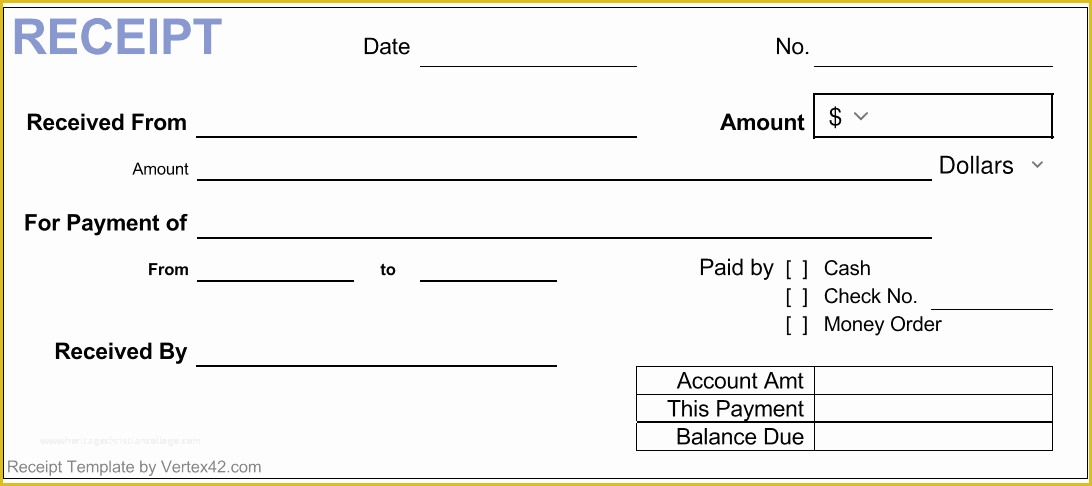

- Collect Documents: Gather your bank statements and all related cash receipts.

- Set a Time: Schedule a regular time for this task to ensure it’s done consistently.

- Check Date Range: Make sure your cash receipts cover the same period as the bank statement.

- Prepare Work Area: Have a calculator, pen, paper, or use reconciliation software.

Detailed Reconciliation Process

Now, let’s delve into the nitty-gritty of matching your bank statements with cash receipts:

1. Review Bank Statements

- Check the opening and closing balances.

- List all transactions including deposits, withdrawals, fees, and interest.

- Make note of any cheques or direct debits that might not have cleared.

2. Categorize and Sum Receipts

- Sort your cash receipts by transaction type: deposits, withdrawals, etc.

- Sum up each category to match against bank entries.

3. Identify Matching Transactions

| Bank Statement | Cash Receipts |

|---|---|

| 100 Deposit</td><td>100 Client Payment | |

| 50 ATM Withdrawal</td><td>50 Petty Cash Receipt |

- Look for exact matches in terms of amount, date, and transaction type.

- Highlight or tick these off as you go to keep track.

4. Address Discrepancies

If there are mismatches:

- Pending Transactions: Transactions might be recorded in your system but not yet reflected in the bank statement.

- Reconcile Outlier Transactions: Account for errors or discrepancies by making adjustments.

- Investigate Large Differences: A significant difference could indicate fraud or errors requiring investigation.

5. Adjusting Entries

If you find any discrepancies, you’ll need to make journal entries or adjustments:

- Bank Fees: Record these as expenses.

- Interest Earned: This should be income.

- Pending Transactions: Record the transactions in your books with a note that they are pending.

6. Documentation and Filing

After reconciling:

- Keep a record of the reconciliation, either printed or digital.

- File both your bank statements and your matched cash receipts together for future reference.

📝 Note: Ensure all your documents are clearly labeled and filed systematically to make future reconciliations easier.

Tips for Efficient Reconciliation

- Use Software: Accounting software can automate much of the reconciliation process.

- Regular Reconciliation: Reconcile your statements at least once a month to keep your books up to date.

- Train Staff: Ensure that all those involved understand the importance and process of reconciliation.

- Double-Check: Have someone else review your work to catch any errors.

Regularly matching your bank statements with cash receipts ensures your financial records are accurate, helping you make better business decisions, detect fraud, and comply with legal requirements. This process, when done efficiently, becomes a cornerstone of good financial management, giving you peace of mind regarding your business's financial health.

What if I miss a transaction during reconciliation?

+

Missing a transaction can lead to discrepancies in your records. It’s crucial to go back over your statements and receipts, ensuring no transaction is overlooked. If you find a missed transaction, make an adjusting entry to correct your books.

Can software make bank reconciliation easier?

+

Yes, accounting software can automate much of the reconciliation process by importing bank data, matching transactions, and flagging discrepancies for review. This significantly reduces manual effort and potential errors.

How often should I reconcile my bank statements?

+

Monthly reconciliation is a good practice. However, depending on the volume of transactions, some businesses might opt for weekly or even daily reconciliations to maintain tighter control over their finances.