5 Ways Medicaid Impacts Your Taxable Earnings

Medicaid, a cornerstone of American social welfare, significantly influences various aspects of financial planning, including taxable earnings. Understanding how Medicaid interacts with your taxes can provide valuable insight into optimizing your financial strategy. Here, we delve into five key ways Medicaid impacts your taxable earnings and what you need to know to manage your taxes efficiently.

1. Tax Deductions for Medical Expenses

One of the primary ways Medicaid impacts taxable earnings is through tax deductions for medical expenses. If you’re enrolled in Medicaid, you might be eligible to claim these expenses:

- Out-of-Pocket Costs: Medicaid typically covers a significant portion of your healthcare costs, but any out-of-pocket expenses can be claimed as itemized deductions if they exceed 7.5% of your adjusted gross income (AGI).

- Medicaid Premiums: If you pay premiums or co-payments, these are considered medical expenses that can potentially reduce your taxable income.

Here’s a simple table illustrating a hypothetical scenario:

| Total Medical Expenses | AGI | Eligible Deduction |

|---|---|---|

| 5,000</td> <td>40,000 | 5,000 - (40,000 * 0.075) = $2,000 |

💡 Note: Always keep detailed records of your medical expenses to substantiate your claims, including receipts, co-payment logs, and premium payment statements.

2. Income Limits and Tax Credits

Medicaid’s eligibility is determined by income limits, which indirectly affect your tax strategy:

- Income Eligibility: Your income must fall below certain thresholds to qualify for Medicaid. This requirement can influence your decision regarding tax credits like the Earned Income Tax Credit (EITC).

- Phase-Outs: If you approach or exceed Medicaid income limits, your tax credits might begin to phase out, impacting your take-home income.

3. Impact on Health Savings Accounts (HSAs)

Enrolling in Medicaid can affect your eligibility for Health Savings Accounts (HSAs):

- Ineligibility for HSAs: Medicaid enrollees are generally not eligible for HSAs, which can offer tax benefits like tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

However, if you’re transitioning to or from Medicaid, there are considerations:

- 12-Month Look-Back Period: The IRS looks back 12 months from your HSA contribution to determine Medicaid coverage, affecting your HSA contributions.

📝 Note: If you're considering an HSA, make sure to review the eligibility criteria carefully to avoid any tax penalties due to incorrect contributions.

4. Taxable Events upon Change in Coverage

Changing from private insurance to Medicaid or vice versa can create taxable events:

- COBRA Premium Payments: If you’re paying for COBRA while transitioning, any premiums paid while on Medicaid might be refundable.

- Retirement Account Withdrawals: Withdrawing funds from a retirement account to cover medical expenses while on Medicaid can have tax implications, especially if you’re not taking qualified distributions.

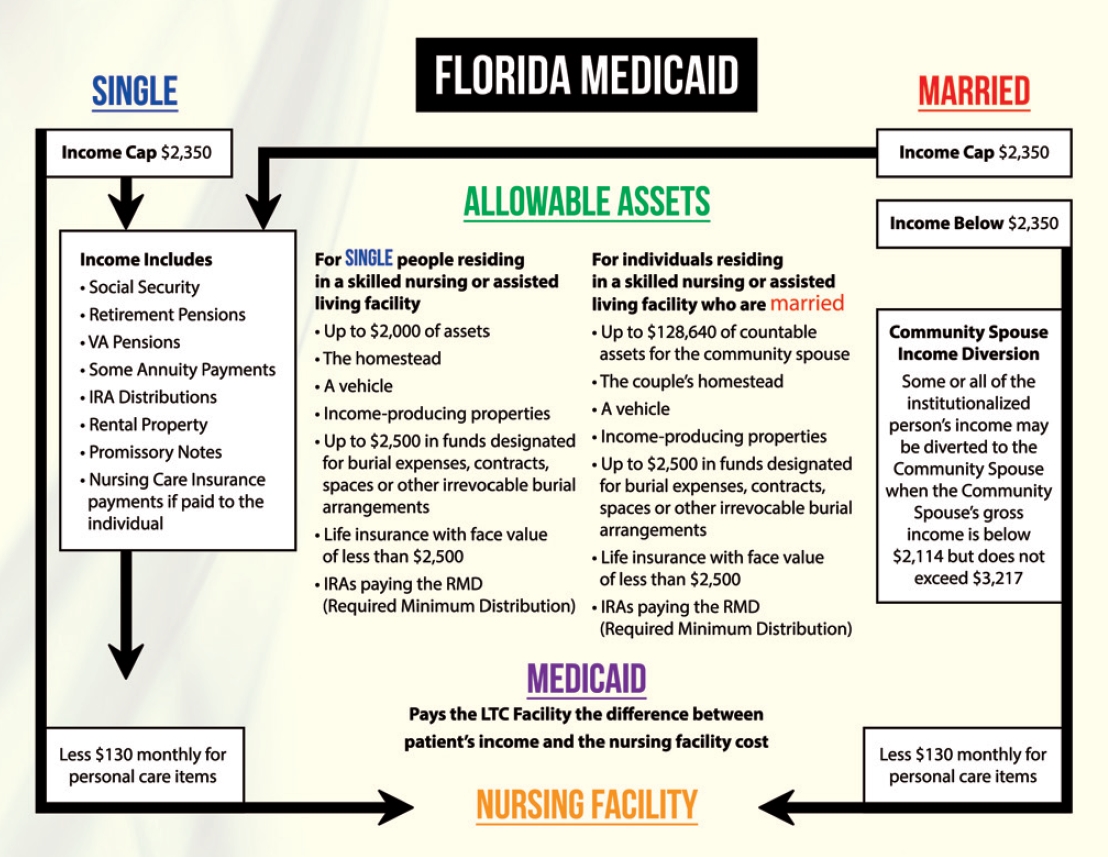

5. Medicaid Planning and Estate Taxes

Medicaid planning for long-term care involves estate tax considerations:

- Estate Recovery: Medicaid has the right to recover expenses after the recipient’s death. This can impact estate planning, reducing the taxable estate if assets are liquidated to reimburse Medicaid.

- Asset Transfers: Transferring assets to qualify for Medicaid can trigger a penalty period and potentially disqualify you from benefits, affecting estate taxes.

As you navigate the complexities of Medicaid and its interaction with your taxable earnings, consider how these five aspects can shape your financial landscape:

- The ability to claim tax deductions for medical expenses can lead to significant tax savings.

- Medicaid income limits influence your eligibility for tax credits and require careful tax planning.

- The interplay between Medicaid and HSAs can impact your tax strategy, especially during transitions.

- Taxable events occur when switching coverage, requiring attention to avoid unintended tax liabilities.

- Medicaid planning involves estate tax considerations, necessitating proactive financial planning.

The interaction between Medicaid and your taxable earnings isn’t just about tax filings; it’s about strategic planning that can optimize your financial health. Whether you’re dealing with medical expenses, planning for retirement, or ensuring a smooth estate transition, understanding these impacts is crucial. Here are some key takeaways:

- Keep meticulous records of medical expenses, even while on Medicaid.

- Consult with a tax advisor or financial planner when dealing with transitions from private insurance to Medicaid or vice versa.

- Plan for long-term care and its implications on your estate and taxes.

- Stay informed about changes in Medicaid policy that might affect your tax situation.

Can I claim medical expenses while on Medicaid?

+

Yes, you can claim any out-of-pocket medical expenses as itemized deductions if they exceed 7.5% of your AGI.

What happens if my income exceeds Medicaid limits?

+

If your income surpasses the threshold, you may lose Medicaid eligibility, affecting your tax credits and deductions.

Are HSAs allowed while on Medicaid?

+

No, Medicaid enrollees are not eligible for HSAs, but you should consider a 12-month look-back period during transitions.

How does Medicaid impact estate taxes?

+

Medicaid planning can reduce the taxable estate through the recovery of benefits paid, affecting estate planning strategies.

What should I do if I need to switch from private insurance to Medicaid?

+

Consult with a financial advisor to understand the tax implications and plan for any potential tax events during the transition.