Gross Receipts: Your Complete Guide to Earnings

Gross receipts are a fundamental aspect of financial reporting for any business, offering a snapshot of total earnings before any deductions. Whether you're an entrepreneur, a small business owner, or just someone curious about finance, understanding gross receipts is key to grasping your company's financial health. This post explores gross receipts, why they matter, how they differ from other income metrics, and how you can accurately report and use them for better financial planning.

What Are Gross Receipts?

Gross receipts refer to the total income a business generates from its normal business operations, including:

- Sales of goods or services

- Interest, dividends, and royalties received

- Rents from property

- Payments for services

They represent the total revenue before any adjustments, deductions, or costs are subtracted. For a clear picture, consider gross receipts as the top line of your income statement.

💡 Note: Gross receipts are not to be confused with profit, as they do not account for expenses.

The Importance of Gross Receipts

Why do gross receipts matter? Here are several key reasons:

- Financial Health Indicator: They provide an overview of the business's earning power.

- Tax Purposes: Many jurisdictions use gross receipts as a basis for taxation, especially for gross receipts taxes.

- Loan Eligibility: Lenders often look at gross receipts to determine a business's ability to repay loans.

- Business Planning: Knowing your gross receipts helps in forecasting, budgeting, and setting sales targets.

Differences Between Gross Receipts, Gross Income, and Net Income

To avoid confusion, here's a table highlighting the differences:

| Metric | Definition |

|---|---|

| Gross Receipts | The total income received from all sources, without deductions. |

| Gross Income | Gross receipts minus the cost of goods sold (COGS) and possibly some direct costs. |

| Net Income | The profit after all expenses, taxes, and deductions have been subtracted from gross income. |

How to Calculate Gross Receipts

Calculating gross receipts is straightforward:

- Sum all income: Include all revenue from sales, services, interest, rent, etc.

- Exclude non-operating income: This means ignoring things like proceeds from selling long-term assets or capital gains.

- Do not deduct expenses: Gross receipts are pre-expense.

Here's a simple example:

- Sales for the month: $20,000

- Interest from savings account: $200

- Rental income: $1,000

The gross receipts would be: $20,000 + $200 + $1,000 = $21,200.

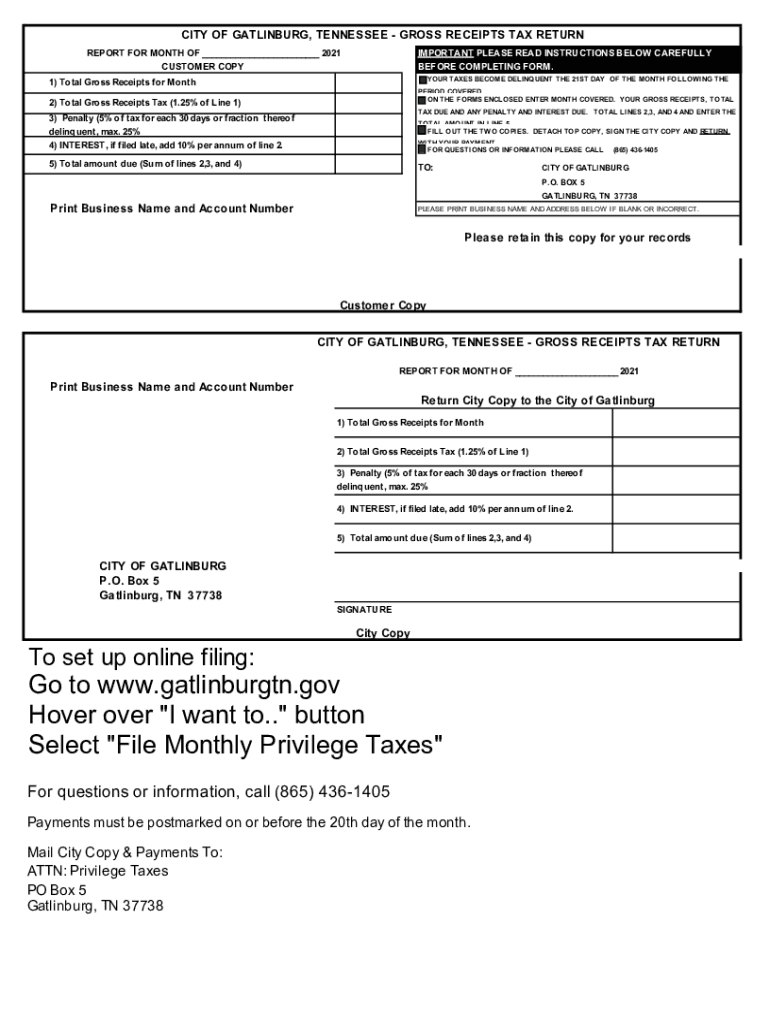

Reporting and Tracking Gross Receipts

Reporting gross receipts accurately is crucial for legal compliance and financial analysis. Here's how to do it:

- Keep Detailed Records: Document every source of income. Use accounting software or manual logs to track all receipts.

- Create Invoices and Receipts: Always issue receipts for transactions, especially for services provided or goods sold.

- Regular Audits: Conduct regular internal audits to verify the integrity of your financial reporting.

- Use Accounting Software: Software like QuickBooks or Xero can help automate tracking and reduce errors.

🔍 Note: Regularly update your records to reflect changes in income sources or financial regulations.

Leveraging Gross Receipts for Business Planning

Gross receipts can inform several strategic decisions:

- Expansion: If gross receipts are consistently increasing, it might be a signal to expand operations or invest in growth.

- Cost Management: Analyzing gross receipts alongside costs can reveal areas where expenses can be trimmed for better profitability.

- Market Analysis: Growth in gross receipts might indicate that your products or services are in demand, suggesting market expansion or product development.

- Financial Benchmarking: Use gross receipts to benchmark against industry averages or competitors to understand your market position.

In Conclusion

Gross receipts are more than just a number; they are a vital indicator of your business's financial activity and potential. By understanding, tracking, and correctly reporting gross receipts, you equip yourself with the knowledge to make informed business decisions, meet legal requirements, and strategically plan for future growth. From recognizing the difference between gross and net income to using gross receipts for financial planning, this comprehensive understanding ensures you navigate your business's financial landscape with confidence and precision.

What is the difference between gross receipts and gross income?

+

Gross receipts are the total income from all sources without any deductions. Gross income, however, subtracts the cost of goods sold (COGS) and possibly some direct costs from gross receipts.

Do gross receipts include capital gains?

+

No, gross receipts typically exclude capital gains, which come from the sale of long-term assets and are considered non-operating income.

How should I report gross receipts for tax purposes?

+

Reporting gross receipts for taxes depends on your jurisdiction. Generally, you need to document all income sources on your tax return. For detailed guidance, consult a tax professional or the tax authority’s guidelines specific to your area.

Can I deduct expenses from my gross receipts?

+

No, expenses are not deducted from gross receipts. Gross receipts are the total income before any expenses or deductions are considered.

Why is it important to track gross receipts?

+

Tracking gross receipts is crucial for assessing the financial health of your business, planning for taxes, securing loans, and making strategic business decisions based on your income trends.