5 Ways to Organize Your Cash Drawer Receipts

When running a cash-intensive business, one of the challenges you might face is keeping your cash drawer receipts organized. Proper organization not only helps in daily operations but also streamlines your end-of-day tally and makes audits or bookkeeping significantly easier. Here are five effective strategies to keep your cash drawer receipts in order:

1. Implement a Receipt Sorter

A receipt sorter or organizer is your first line of defense against the chaos of loose receipts. Here’s how to get started:

- Select a Sorter: Choose a receipt sorter that fits your needs, whether it’s a standalone unit or one integrated into your POS (Point of Sale) system.

- Categorize: Decide on categories for sorting receipts. Common categories might include sales, refunds, cash drops, coupons, and errors.

- Label Clearly: Each slot or compartment should be clearly labeled to avoid confusion.

🎯 Note: Ensure that your staff knows which receipts go where to maintain consistency.

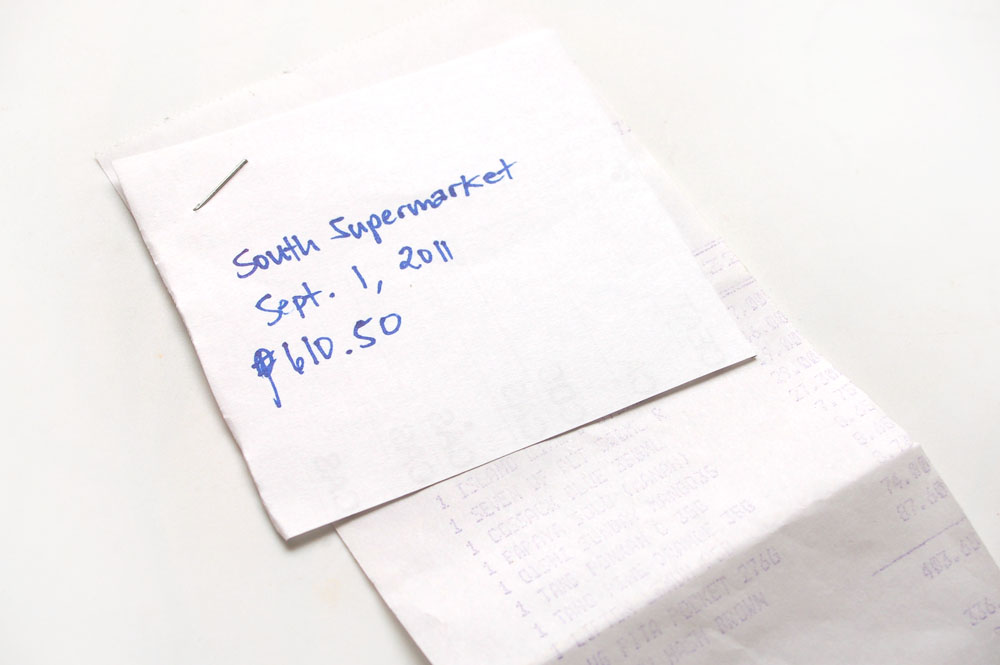

2. Use Receipt Staples

To prevent loss or misplacement, stapling or paper-clipping groups of related receipts together can be highly effective:

- Group by Transaction: Staple all receipts related to one transaction together to keep them from getting mixed up.

- Date and Time: If there’s a logical grouping by date or time, consider stapling those together as well.

- Reconcile with Cash: When reconciling cash in your drawer, having receipts grouped makes it easier to match the cash with the transaction slips.

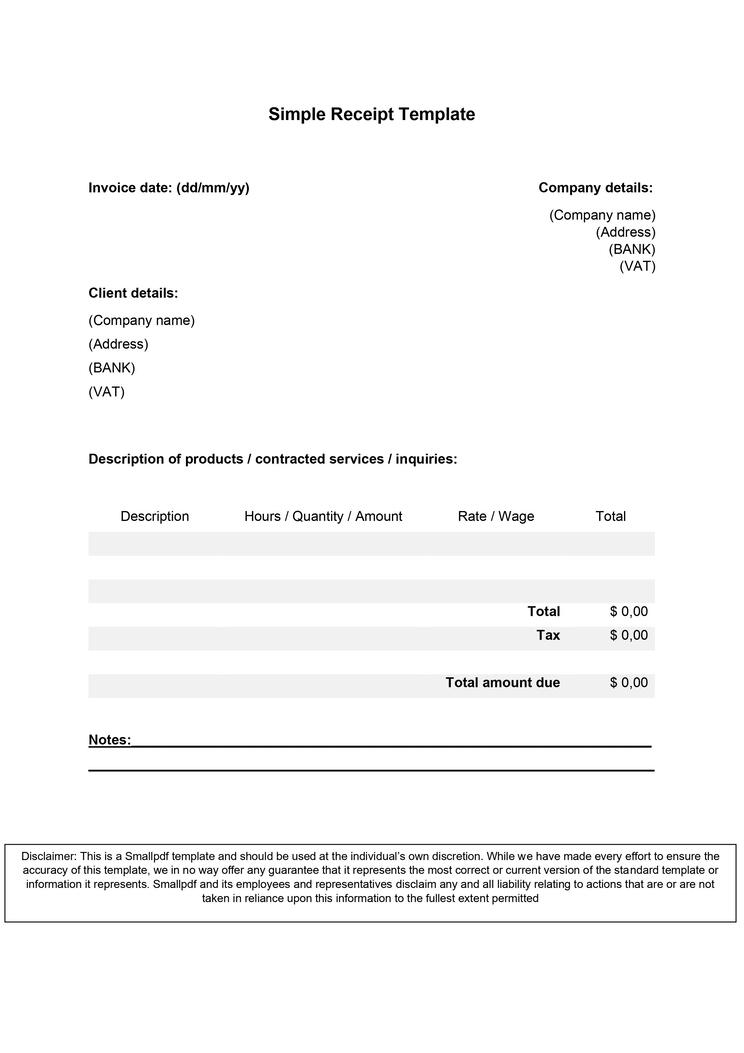

3. Utilize Digital Receipt Management

With technology at our fingertips, going digital can drastically improve receipt organization:

- Point of Sale Systems: Use POS systems that automatically generate digital receipts, which can be synced to a computer or cloud storage for easy retrieval.

- Scanning: Invest in a scanner to digitize paper receipts. Ensure to remove sensitive information before scanning if required by law.

- Software: Employ receipt management software that can categorize, store, and manage receipts efficiently.

4. Daily Cash Drawer Log

| Time | Cash In | Cash Out | Total Cash | Receipt Count |

|---|---|---|---|---|

| Start of Day | 100</td> <td>0 | 100</td> <td>0</td> </tr> <tr> <td>12:00 PM</td> <td>350 | 150</td> <td>300 | 12 |

A daily log helps in tracking the flow of cash through the drawer:

- Record Transactions: Each time cash enters or leaves the drawer, log it along with the number of receipts.

- End-of-Day Summary: This log provides an at-a-glance summary for end-of-day reconciliation.

📅 Note: Keep this log accessible to all staff members responsible for cash handling.

5. Regular Training and Audits

Lastly, ensure your staff are trained and periodically audited:

- Training: Regularly train your employees on the importance of maintaining an organized cash drawer and how to do so.

- Audits: Conduct surprise or scheduled audits to ensure that the procedures are being followed, providing constructive feedback to your team.

In summary, organizing your cash drawer receipts involves using physical tools like receipt sorters and staples, embracing digital solutions, keeping accurate logs, and maintaining a well-trained staff. Not only does this help in daily business operations, but it also ensures financial accuracy and prepares you for any official audits or inspections.

What is the best way to categorize receipts?

+

It’s often useful to categorize receipts by sales, refunds, cash drops, coupons, and errors. Choose categories that reflect your business’s common transactions for optimal organization.

How can digital management help with receipt organization?

+

Digital receipt management allows for categorization, storage, and easy retrieval of receipt data, reducing the need for physical storage and minimizing the risk of losing receipts.

Why is maintaining a daily cash drawer log important?

+

Maintaining a daily log helps track cash flow, ensures accuracy in transactions, and provides an essential audit trail for financial reviews and bookkeeping.

What should I do if I find discrepancies in the cash drawer?

+

If discrepancies occur, review the daily log, reconcile the cash with the receipts, and check for any errors or potential fraud. Implement corrective measures or staff training as necessary.