Can 1099-S Forms Be Split Between Recipients?

The IRS Form 1099-S is essential for reporting the sale or exchange of real estate property. It provides the necessary details for both the seller and the buyer regarding the transaction amount, the date of sale, and other vital information that affects their tax obligations. However, when it comes to splitting the information on a 1099-S between multiple recipients, there's a certain amount of confusion and questions that arise.

Can You Split 1099-S Forms?

First, let’s understand what splitting a 1099-S form entails:

- Original Transaction: The 1099-S form is typically issued when real property, including real estate sales, land, or cooperative housing, is sold or transferred.

- Multiple Recipients: This might involve different parties like sellers, real estate agents, attorneys, and title companies, all of whom might be involved in the transaction.

The IRS does not explicitly allow or disallow splitting a 1099-S form between recipients in their official guidance. However, here’s how this situation can be approached:

- Multiple 1099-S Forms: Instead of trying to split the form, each party involved might receive their own 1099-S form, with the relevant details tailored to their portion of the transaction. This ensures everyone involved receives accurate tax information relevant to their responsibilities.

- Shared Transaction Details: The 1099-S form typically contains details about the entire transaction. While the form can’t be split, all recipients receive a copy of this form detailing the full amount of the sale or transfer, regardless of how the funds are distributed among them.

Scenarios Where Splitting May Seem Relevant

There are situations where recipients might seek to divide the form:

- Co-Ownership: If multiple people jointly owned the property, they might wish to split the income from the sale for their tax purposes.

- Divorce or Separation: In cases where a property is part of the marital assets being split between divorcing parties.

- Estates: When the property is inherited by multiple heirs who then sell the property.

⚠️ Note: While these scenarios might warrant distributing the proceeds differently, this is not considered ‘splitting’ in the IRS’s formal tax reporting sense.

Correct Reporting Practices

The IRS requires that a 1099-S form be issued:

- To the Seller(s): This form must include all relevant information about the transaction.

- To Other Parties Involved: Real estate professionals involved in the sale also receive copies of the 1099-S as part of their record-keeping duties.

When handling a real estate transaction:

| Step | Action |

| 1 | Identify all parties involved in the transaction, including co-owners, attorneys, real estate agents, etc. |

| 2 | Determine how the property’s sale proceeds are to be divided. This is typically outlined in the sales agreement or legal documents. |

| 3 | Prepare a separate 1099-S form for each recipient based on their legal entitlement to the sale proceeds. |

| 4 | File the necessary 1099-S forms with the IRS and distribute the copies to the recipients. |

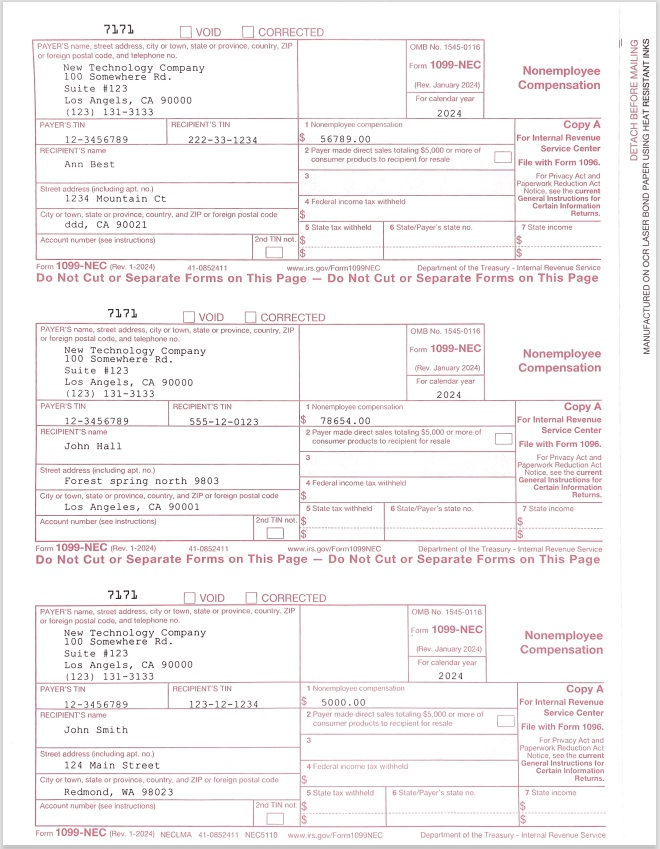

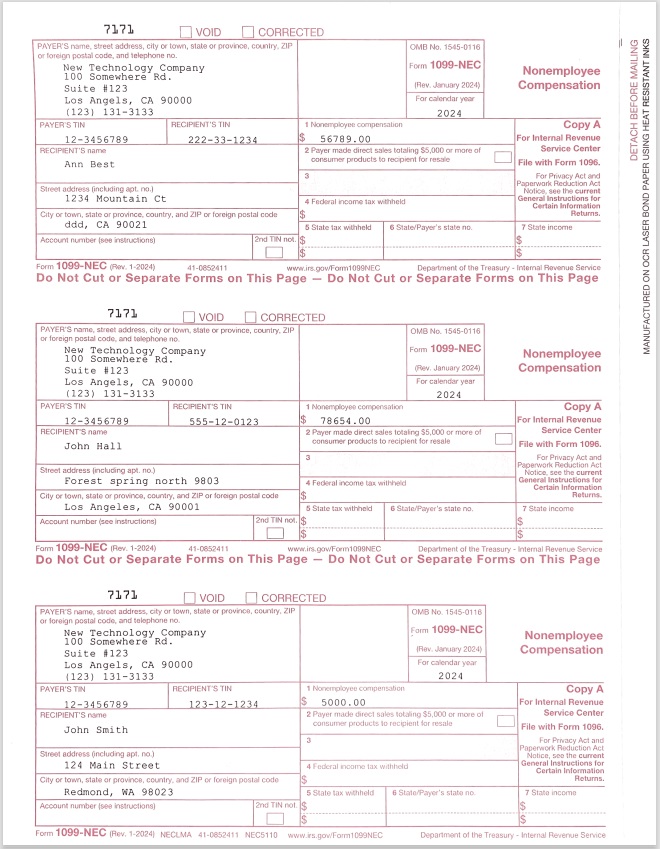

In the end, despite the complexity of real estate transactions, the IRS requires that each party involved receives an accurate 1099-S form detailing the transaction. These forms might look similar for co-owners but contain different dollar amounts or distribution percentages:

- The information on each form should reflect the portion of the sale or transfer that corresponds to each recipient's share.

- It's critical to ensure that the total amounts match the total transaction, preventing discrepancies in tax reporting.

📝 Note: It's always wise to consult with a tax advisor or attorney when dealing with complex property transactions to ensure compliance with IRS regulations.

Concluding, while the IRS does not allow for the 'splitting' of a single 1099-S form between multiple recipients, careful preparation of individual forms for each party involved ensures accurate tax reporting. The focus should be on providing detailed, personalized tax documentation that reflects the recipient's role and share in the transaction.

What should I do if I’m part of a group that jointly owns and sells a property?

+

Each owner should receive their own 1099-S form, detailing their share of the sale proceeds. Ensure the total amounts on all forms equal the total transaction value to avoid tax reporting issues.

Can I amend a 1099-S form if a mistake is found?

+

Yes, you can file a corrected 1099-S form (Form 1099-S Corrected) with the IRS and distribute corrected copies to the recipients.

What happens if the 1099-S form is not filed with the IRS?

+

Failing to file or report a 1099-S form can result in penalties from the IRS, which can be costly. It’s crucial to ensure all forms are filed on time to avoid these penalties.