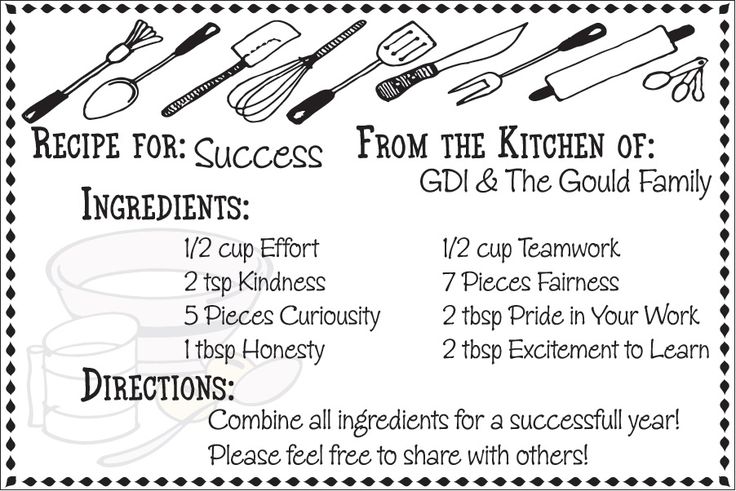

Essential Recipe Book for Small Business Success

Welcome to the guide that every small business owner should keep handy. Whether you're a budding entrepreneur or a seasoned business operator, the key ingredients to running a successful small business remain largely the same. This recipe book isn't about culinary delights but rather the essential steps and ingredients you need to bake up success in your small business venture.

1. Vision and Passion: Your Secret Sauce

Every successful business begins with a clear vision. This vision acts as your north star, guiding your business through thick and thin.

- Define Your Vision: Write down what you want your business to achieve. Make it specific, measurable, attainable, relevant, and time-bound (SMART).

- Cultivate Passion: Passion is the fuel that keeps you going. Remember, when passion meets preparation, success is often the result.

2. Market Research: Gathering the Ingredients

Before you start your business, you must understand the market. Here’s how to do it:

- Identify Your Market: Who are your customers? What do they want?

- Competitor Analysis: Who else is doing what you want to do? What are they doing well, and where do they lack?

- Trend Analysis: Use tools like Google Trends or social media to see what's gaining traction.

🔍 Note: Market research is not a one-time event. Continuously monitor changes in consumer behavior and market dynamics.

3. Business Plan: Your Recipe Card

Your business plan is essentially the recipe for your business success. Here's what it should include:

| Component | Description |

|---|---|

| Executive Summary | An overview of your business and its plans. |

| Company Description | What your business does and why it exists. |

| Market Analysis | Detailed research on your market, customers, and competitors. |

| Organization & Management | How your business is structured, including key personnel. |

| Services/Products | What you're selling or what services you're offering. |

| Marketing & Sales Strategy | How you plan to attract and sell to customers. |

| Financial Projections | Forecasts for revenue, expenses, and profitability. |

4. Legal Framework: Baking Within the Law

Understanding the legal side of business is crucial:

- Business Structure: Decide between Sole Proprietorship, Partnership, LLC, or Corporation.

- Registrations and Licenses: Ensure you're compliant with all necessary regulations.

- Intellectual Property: Protect your brand, product, or service names.

5. Funding: Measuring Out the Capital

Without adequate funding, your business idea remains just that—an idea. Here are ways to fund your business:

- Bootstrapping: Using personal finances or operating with minimal external investment.

- Small Business Loans: Look into options like SBA loans.

- Investors: Crowdfunding, angel investors, or venture capital.

💡 Note: When seeking funding, remember that lenders and investors look for businesses with strong plans, good credit, and growth potential.

6. Branding: Mixing Up Your Unique Identity

Your brand is how your customers perceive you. It involves:

- Logo Design: Ensure it's memorable and represents your business ethos.

- Mission Statement: Craft a compelling mission that reflects your business goals and values.

- Marketing Materials: Business cards, brochures, and website design.

7. Customer Service: Stirring Up Satisfaction

Exceptional customer service can set you apart:

- Responsive Communication: Address inquiries and complaints promptly.

- Personal Touch: Make your customers feel valued, not just another transaction.

- Training: Ensure all employees understand the importance of customer satisfaction.

8. Digital Presence: The Modern Ingredient

In today’s digital age, your online presence is non-negotiable:

- Website: It’s your digital storefront. Make sure it’s user-friendly, informative, and visually appealing.

- Social Media: Engage with your audience on platforms where they spend time.

- SEO and Content Marketing: Optimize your online content to draw in potential customers.

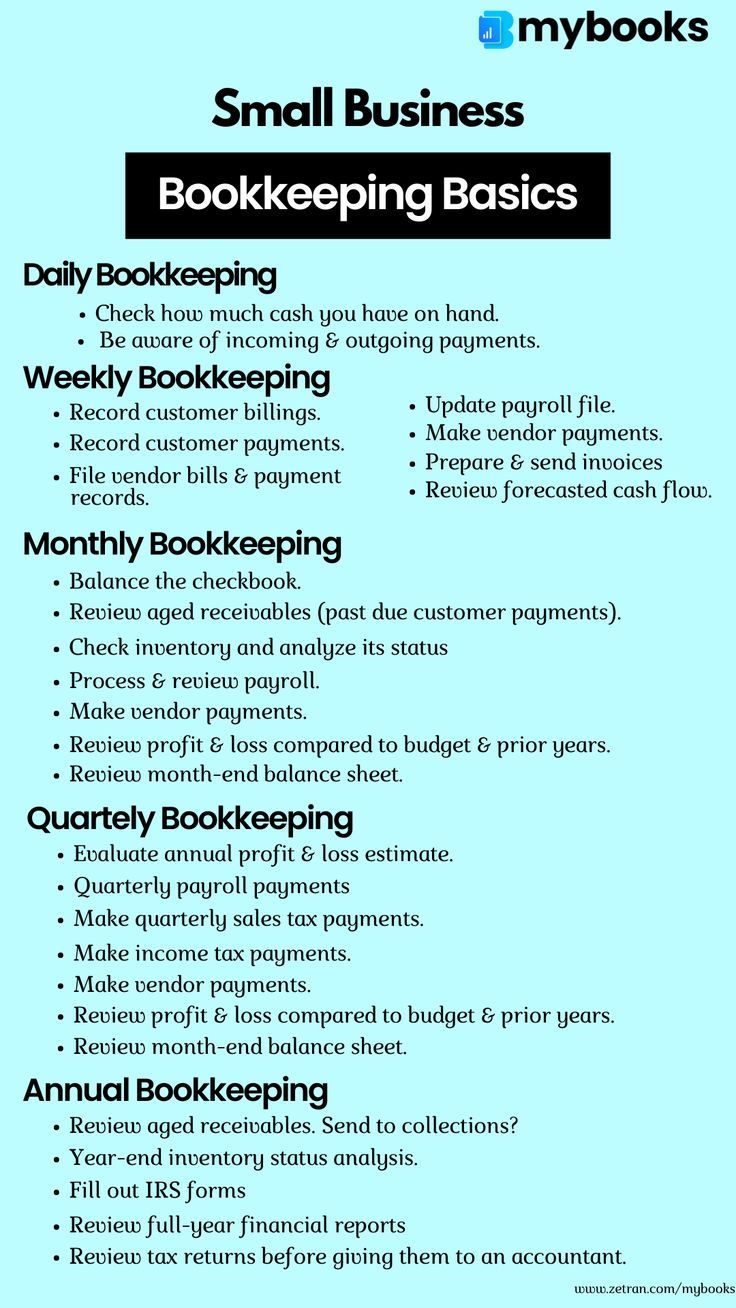

9. Financial Management: Managing Your Business Dough

Here’s how to manage your finances:

- Budgeting: Keep a close eye on your cash flow. Prepare for both the expected and unexpected.

- Tax Planning: Work with a tax advisor to minimize tax liabilities.

- Invoicing and Accounts Receivable: Timely billing and collection are crucial for cash flow management.

In this recipe for success, every step is essential. From crafting a vision that drives your business, through to meticulous market research, creating a detailed business plan, navigating the legal landscape, securing funding, establishing a brand, delivering top-notch customer service, building a digital presence, and managing your finances, each component plays a vital role. Remember, the recipe for small business success is not just about mixing ingredients; it’s about mastering the technique, being adaptable, and consistently delivering quality. Keep this guide close, refer back to it as your business evolves, and you’ll find that with the right approach, your small business can thrive in the competitive market.

How often should I update my business plan?

+

It’s advisable to review and potentially update your business plan annually or when significant changes occur in your business environment.

Can I start a business with no money?

+

While challenging, it’s possible through bootstrapping, bartering, or starting a service-based business that requires minimal initial investment.

What is the most important part of a business plan?

+

The financial projections are often considered the most critical as they show the viability and profitability of your business model.

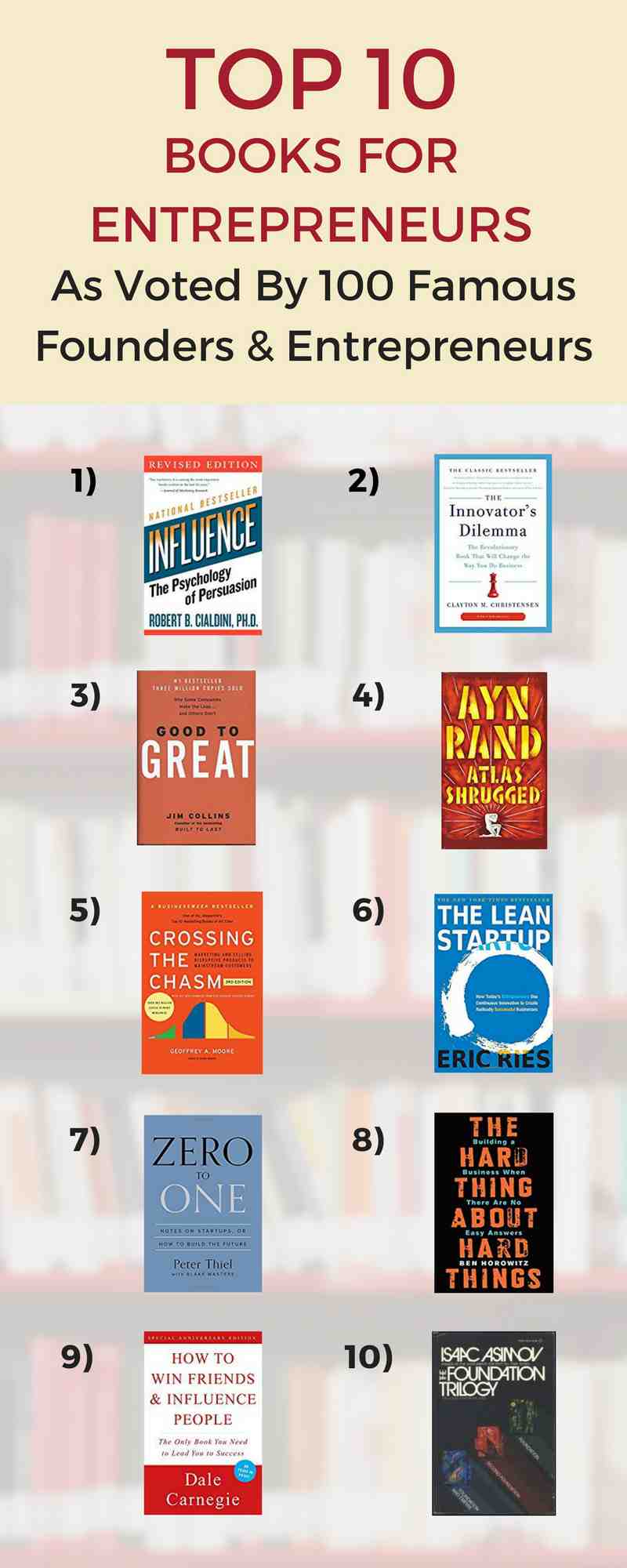

Related Terms:

- recipe book for small business