Property Tax Receipts: Should You Buy Them Up?

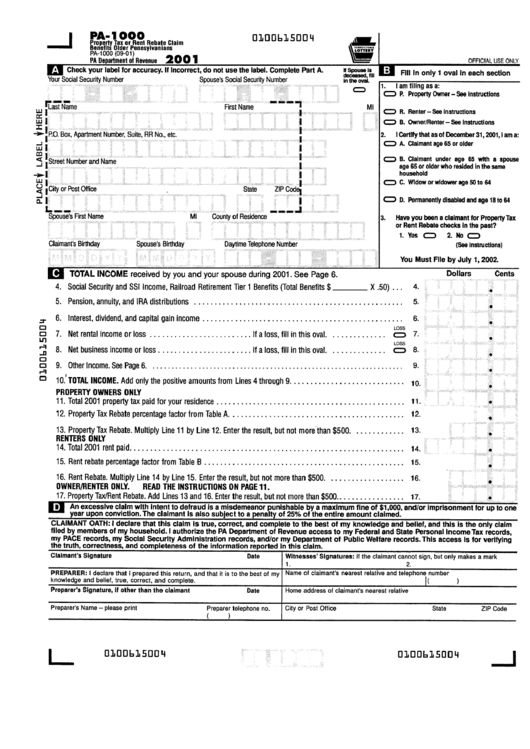

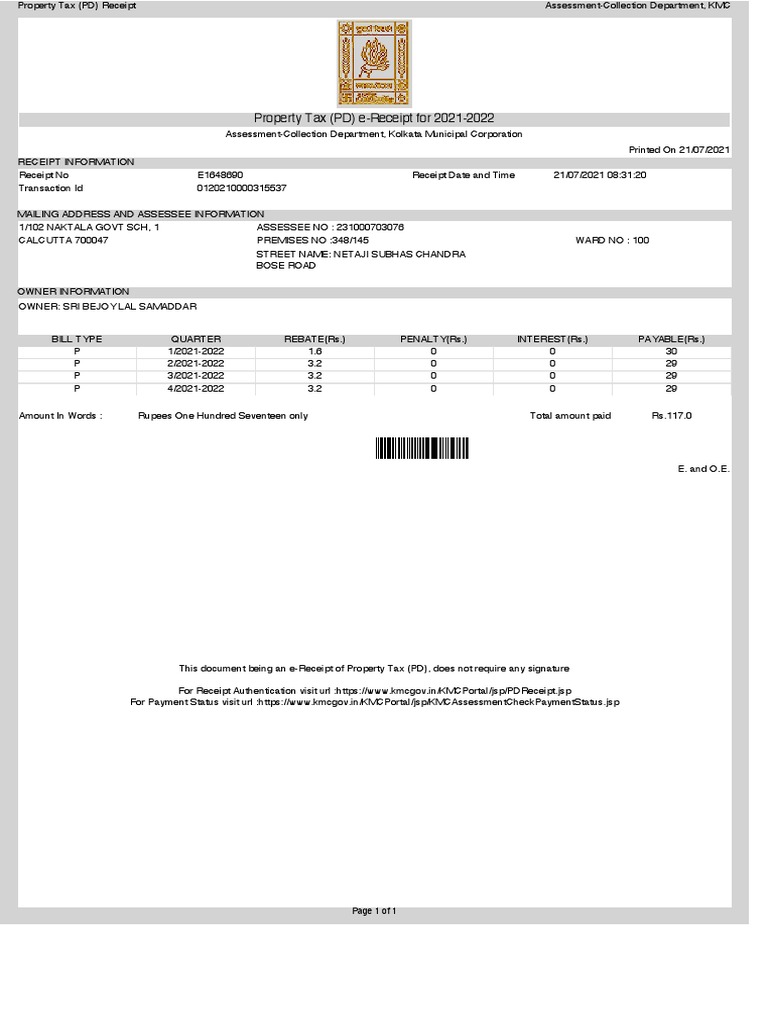

Understanding Property Tax Receipts

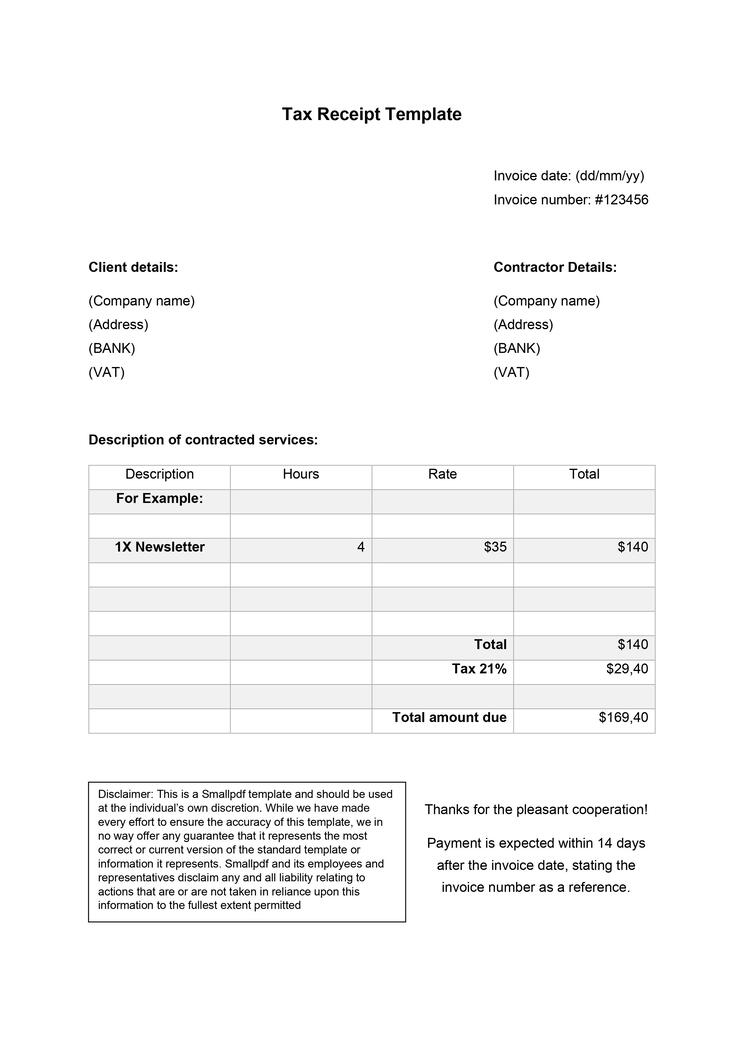

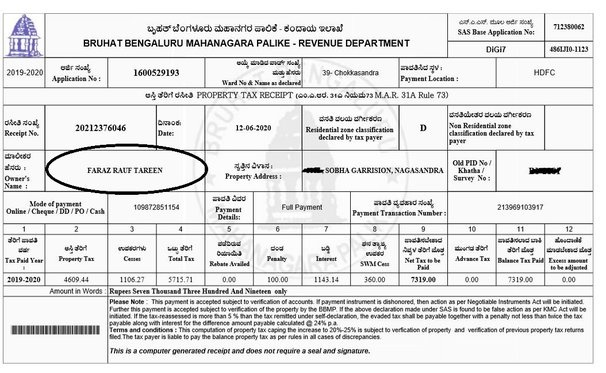

Property tax receipts are legal documents issued by local government authorities to property owners, verifying that the taxes on a given piece of property have been paid. For potential investors, these receipts represent more than just proof of payment; they can be a portal to potentially lucrative investment opportunities.

Before diving into the intricacies of investing in tax receipts, let's explore what they are, how they function, and why some investors consider them a smart financial strategy.

What are Property Tax Receipts?

When a property owner fails to pay their property taxes, the local government has the right to sell the delinquent tax bills to interested parties. This process is designed to help governments recover lost revenue. Here’s a brief rundown:

- Tax Delinquency: If property taxes remain unpaid, a lien is placed on the property.

- Tax Lien Sale: The lien becomes a certificate that can be auctioned off. These tax lien certificates (or tax deeds in some states) are purchased by investors.

- Interest on Investment: The buyer of the tax lien certificate pays the back taxes and receives interest on the investment, typically higher than conventional investment options.

- Redemption Period: Property owners have a redemption period during which they can repay the investor plus interest. If the taxes remain unpaid, the investor might acquire the property through foreclosure.

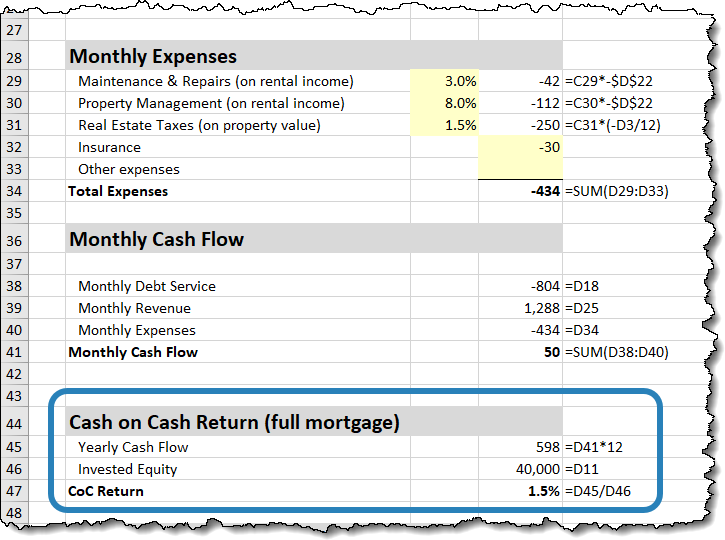

The Appeal of Investing in Property Tax Receipts

Here’s why investors might find tax receipt investments attractive:

- Higher Interest Rates: Returns on tax lien certificates can significantly outpace traditional fixed-income investments.

- Secured by Property: The investment is secured by the property itself, which can be taken over if the taxes remain unpaid.

- Short-Term Gains: Investors often receive returns within one to three years, which is shorter than many real estate investment cycles.

- Less Competition: Fewer investors know about or engage in tax lien investing, reducing the competition at auctions.

The Potential Risks of Investing in Property Tax Receipts

Despite the potential benefits, investing in tax receipts comes with its share of risks:

- Property Condition: You might end up with a property that needs extensive repairs or is undesirable.

- Legal Pitfalls: Understanding local laws, redemption periods, and foreclosure processes requires due diligence.

- Illiquid Investment: Turning over or selling tax liens can be more difficult than other investments.

- Subordinate Liens: Your lien might not be the only one; other liens like mortgages could complicate matters.

Steps to Invest in Property Tax Receipts

If you decide to venture into this investment territory, here are the steps you’ll need to take:

- Research: Understand your state or local jurisdiction’s rules on tax liens.

- Find Sales: Look for upcoming tax lien auctions; many are advertised publicly.

- Due Diligence: Assess property values, taxes owed, potential interest rates, and the properties themselves.

- Bid at Auction: Either attend the auction in person or bid online if available.

- Post-Auction Actions: Fulfill any post-purchase requirements like registering your lien or certificate.

⚠️ Note: Investing in tax receipts is not for the uninformed investor. Familiarity with local laws and a willingness to do the necessary research are key.

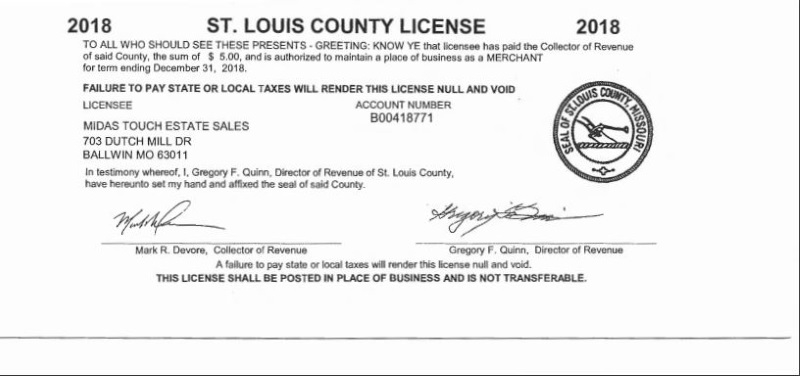

Navigating Tax Liens in Different Jurisdictions

The mechanics of tax lien investing vary from state to state or even between counties. Here’s how it might differ:

- Interest Rates: Some states have fixed rates; others let the market decide during the auction.

- Redemption Period: Lengths can range from a few months to several years.

- Foreclosure Process: The process to take possession of the property if the taxes are not redeemed varies in complexity and timeline.

Maximizing Returns on Property Tax Receipts

To enhance your investment’s return:

- Be Selective: Opt for properties with the best risk-reward ratio.

- Understand Market Cycles: Buying during economic downturns can yield higher returns as property owners are less likely to redeem.

- Work with Professionals: Legal counsel or real estate attorneys can provide vital guidance.

💡 Note: Investing in tax receipts involves more than just buying a piece of paper; it requires a strategic approach to property analysis and market understanding.

Alternatives to Property Tax Receipt Investing

If tax lien investing isn’t suitable, consider these alternatives:

- Direct Real Estate Investment: Buy and manage properties directly.

- REITs: Real Estate Investment Trusts provide a way to invest in real estate without owning property.

- Real Estate Crowdfunding: Platforms allowing smaller investors to pool resources for larger real estate investments.

- Tax Deed Sales: Instead of liens, some areas auction properties outright for unpaid taxes.

Over the years, investing in property tax receipts has provided investors with a niche market for potentially high returns with unique risks. This market's allure lies in its ability to offer investors a different pathway to profit, one that diverges from traditional real estate investments.

Key takeaways include the importance of thorough research, understanding local laws, and strategic investment choices. While this avenue can lead to substantial returns, it's not without its complexities and pitfalls. For those willing to navigate the legal and financial landscape, investing in property tax receipts can open doors to investment opportunities that are often overlooked.

What is the difference between a tax lien certificate and a tax deed?

+

A tax lien certificate gives you a claim on unpaid taxes, while a tax deed provides you with the ownership of the property if the taxes remain unpaid.

Can you invest in property tax receipts in any state?

+

No, tax lien certificate sales are not conducted in every state; some states auction the properties themselves through tax deeds.

How long does it take to see returns on a tax lien investment?

+

Returns can vary, but typically investors see interest payments within one to three years if the taxes are redeemed.