7 Tips for Handling Pending Receipt of Funds

In the bustling world of business, managing the ebb and flow of finances is paramount. A common challenge faced by businesses, freelancers, and even individuals is the pending receipt of funds. Whether it's an invoice payment from a client, a paycheck, or any form of income, the wait for funds can significantly impact operations. Here are seven practical tips to handle this often stressful scenario with grace and efficiency.

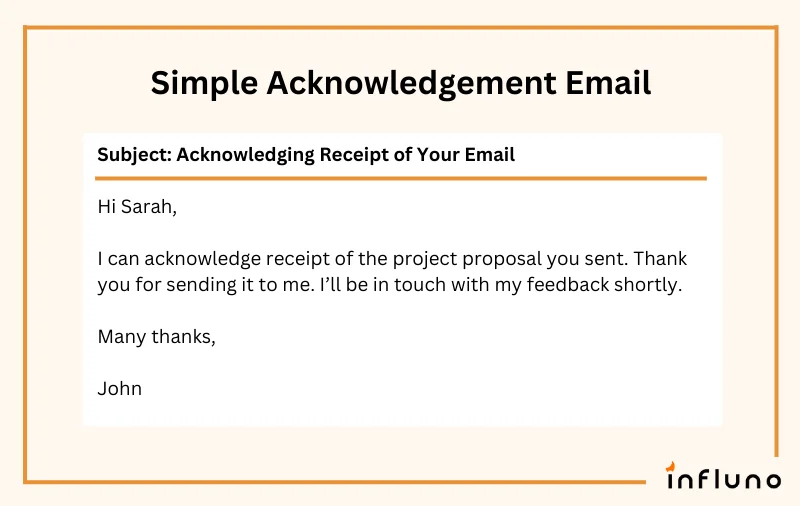

1. Clear Communication

Communication is the bedrock of trust in any relationship, including business ones. When funds are pending:

- Initiate Contact: Reach out to your clients or whoever owes you money as soon as the payment is due or overdue.

- Be Polite and Professional: Keep the tone of your communication professional yet polite. An invoice overdue message template might look like:

Dear [Client Name],

I hope this message finds you well. I am writing to inquire about the status of invoice #[Invoice Number] for the amount of $[Invoice Amount] which was due on [Due Date].

Please let me know if there are any issues or if you need more time to settle this payment. I appreciate your prompt attention to this matter.

Best Regards,

[Your Name]

2. Set Clear Payment Terms

Before the payment is due, ensure:

- Documented Payment Terms: Clearly define payment deadlines, late fees, and accepted payment methods in your contract or agreement.

- Follow-Up Policy: Outline when and how you will follow up on pending payments to prevent misunderstandings.

3. Offer Multiple Payment Methods

In today’s digital age, facilitating a variety of payment options can reduce delays:

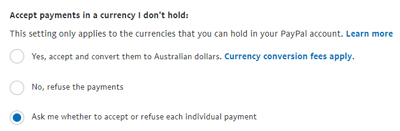

- Digital Wallets: Services like PayPal, Venmo, or Apple Pay can expedite the process.

- Bank Transfers: Setting up ACH payments or direct bank transfers can be efficient.

- Credit Cards: If applicable, accept credit card payments to give clients flexibility.

| Payment Method | Pros | Cons |

|---|---|---|

| Digital Wallets | Fast, user-friendly | Transaction fees, not universally accepted |

| Bank Transfers | Direct, secure | Can be slow, needs bank details |

| Credit Cards | Wide acceptance, rewards for clients | Processing fees, chargeback risks |

4. Implement Late Fees

To encourage timely payments:

- Policy Clarity: State the late fee policy clearly in your terms. For example, a 5% late fee per week after the due date can be an effective deterrent.

- Fairness: Ensure the fee isn’t punitive but rather compensates for the delay and encourages prompt payment.

⏱️ Note: In some jurisdictions, charging late fees might be regulated, so check your local laws.

5. Cash Flow Management

While waiting for payments, effective cash flow management is critical:

- Budget Reserves: Have a reserve fund for operational costs to bridge the gap.

- Forecasting: Use cash flow forecasting tools to predict when funds might come in and how much you’ll need in reserves.

- Short-term Financing: Consider lines of credit or short-term loans for emergency funds, but be cautious about interest rates and repayments.

6. Credit Control

If delays become a pattern:

- Review Credit Policies: Adjust your credit terms or credit checks for new clients if you notice a pattern of late payments.

- Client Evaluation: Reevaluate client relationships, considering payment history and reliability.

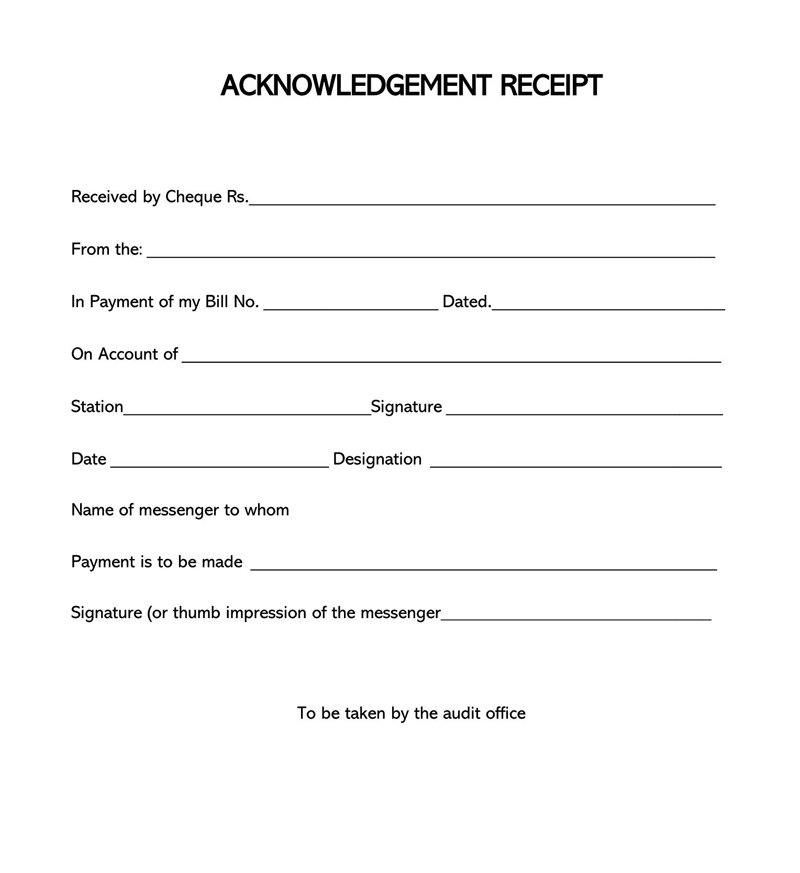

7. Document Everything

To resolve disputes or for future reference:

- Maintain Records: Keep meticulous records of invoices, payment terms, communication, and agreements.

- Use Contract Management Tools: Tools like DocuSign or HelloSign can help manage contracts and track signatures for legal backup.

By following these tips, you can mitigate the stress of pending funds receipt and maintain a healthy cash flow in your business. Managing finances requires patience, foresight, and strategic planning. Keep in mind that communication, clear terms, and a proactive approach to financial management are the keys to maintaining smooth operations and good relationships with clients or employers.

How often should I follow up on late payments?

+

It’s recommended to follow up immediately after the due date, and then weekly or biweekly if payments are still outstanding. Excessive follow-ups can strain relationships, so balance is key.

Is it legal to charge late fees for overdue payments?

+

Yes, but the legality depends on local regulations. Ensure your late fee policy is compliant with these laws to avoid legal issues.

What should I do if a client repeatedly pays late?

+

Review your credit terms for future dealings with this client. Consider adjusting your policies, perhaps requiring prepayments or shorter credit periods, or even stopping services until payment issues are resolved.