Top 5 Benefits of Paying with Cash and Receipts

The Timeless Advantages of Cash: Why Paying with Cash and Keeping Receipts is Still Beneficial

In an era where digital transactions dominate the financial landscape, the practice of paying with cash and collecting receipts might seem antiquated. However, there are compelling reasons why sticking to this traditional method can still offer significant advantages. Let's delve into the top 5 benefits of paying with cash and maintaining receipts.

1. Budget Control and Financial Discipline

One of the most straightforward benefits of using cash is that it helps with budget management. When you pay with cash, you physically see money leaving your wallet, making it easier to track spending. Here’s how:

- Visibility: You instantly see the amount you’re spending.

- Physical Limit: Cash enforces a spending ceiling, as you can only spend what you have.

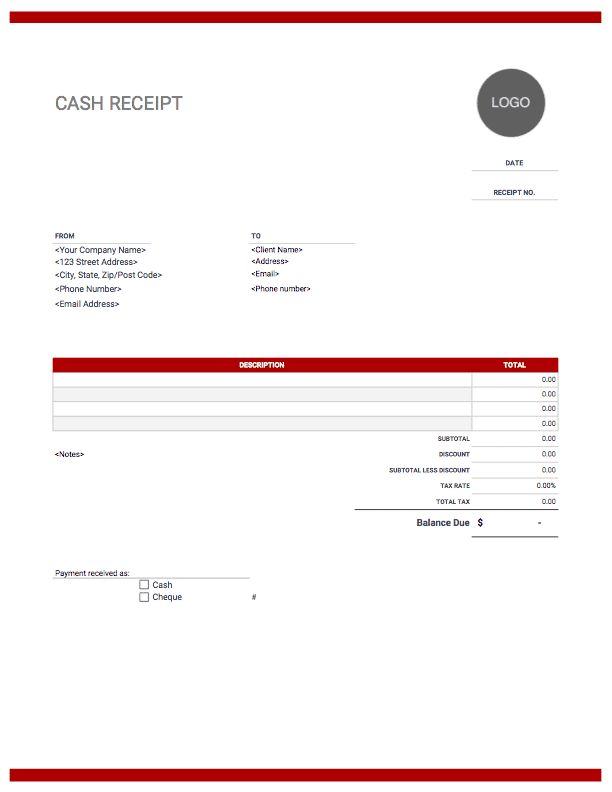

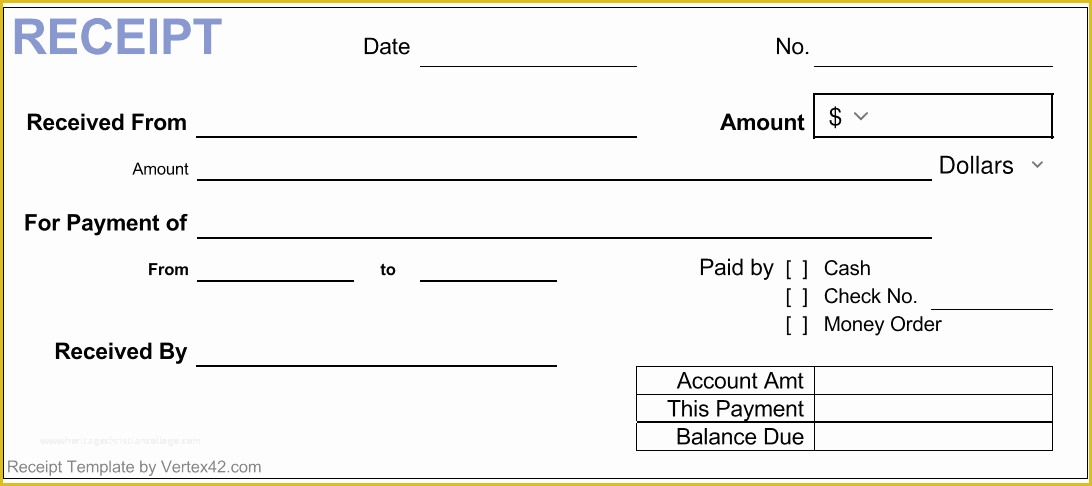

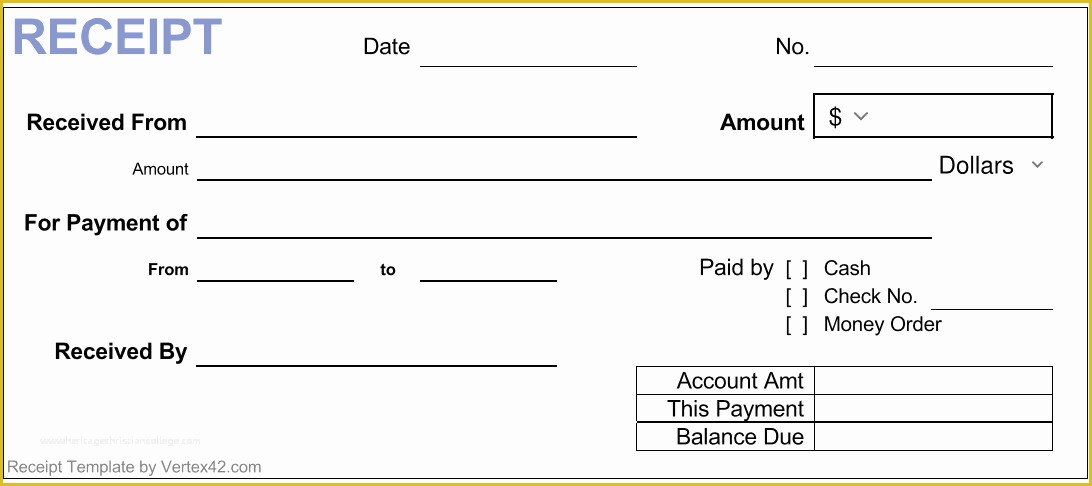

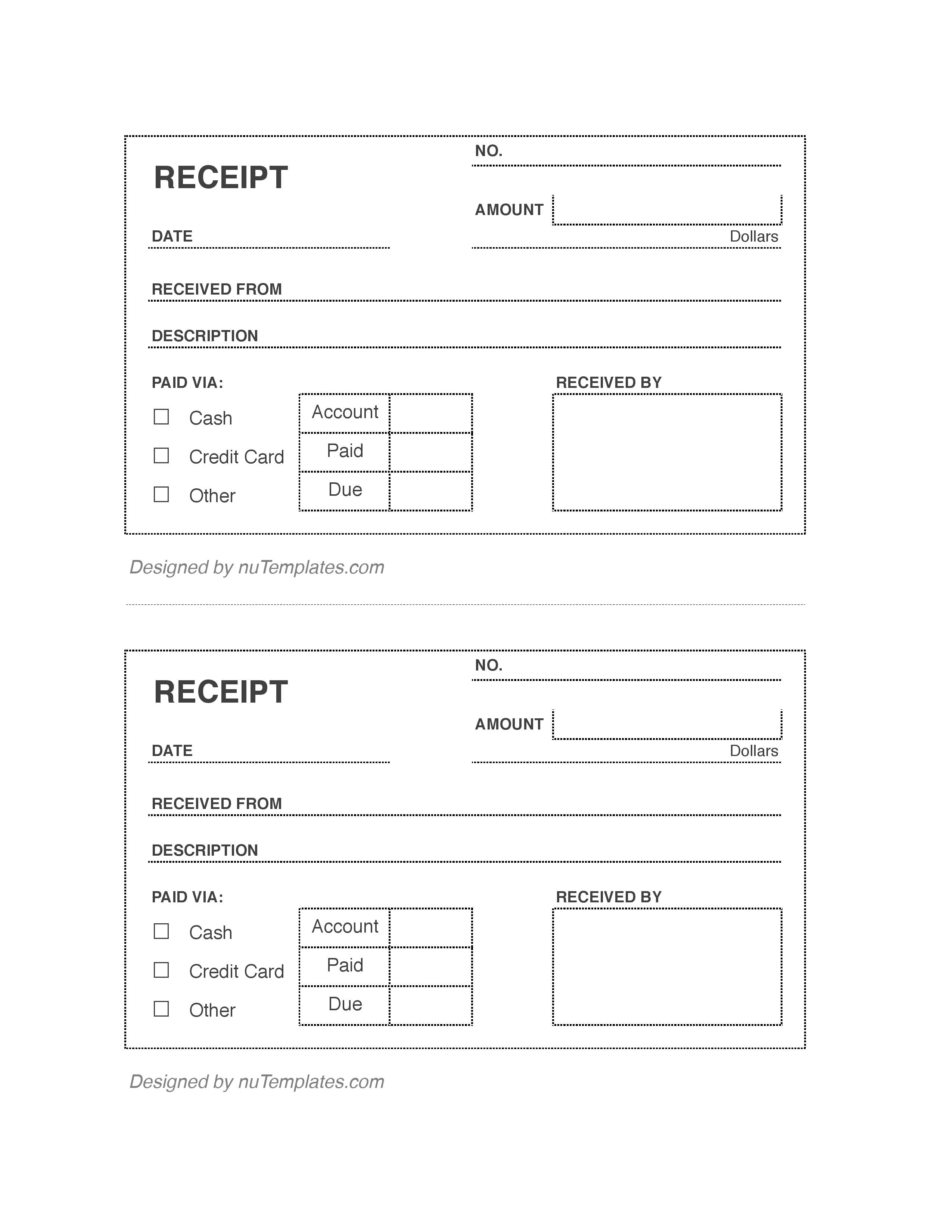

- Tangible Evidence: Receipts serve as tangible proof of expenditure, aiding in future budget planning.

How Receipts Enhance Budget Control

By keeping receipts:

- You can keep track of what you’ve spent on various categories, such as food, entertainment, or clothing.

- Receipts act as a paper trail that can be cross-checked with your bank statements to detect discrepancies or unauthorized charges.

2. Privacy and Security

Using cash provides a higher level of transaction privacy compared to digital methods:

- Reduced Risk of Data Breaches: When you pay with cash, there’s no exchange of personal information, reducing the risk of identity theft or fraud.

- Less Digital Footprint: Unlike digital payments, which leave a traceable record, cash transactions do not create a digital record of your spending habits.

Why Receipts Are Still Important for Privacy

While receipts can’t provide the same level of anonymity as cash itself, they:

- Can be used as proof of transaction in case of disputes without exposing digital transaction records.

- Offer a fallback when you need to recall where and when money was spent without revealing personal financial information.

3. Merchant Discounts and Cash Incentives

Many businesses still offer incentives for paying with cash to bypass the fees associated with credit card transactions:

- Cash Discounts: Businesses sometimes provide discounts to cash buyers due to lower transaction costs.

- Incentives: Some merchants have loyalty programs or reward systems for cash transactions.

Receipts as Proof of Purchase

Receipts serve multiple purposes:

- They allow you to take advantage of any discounts or rewards you might be eligible for due to cash payment.

- They provide a record for returns, warranties, or exchanges, which can be particularly useful for cash purchases where there might not be an electronic trail.

🤑 Note: Always check if businesses offer cash-specific discounts or incentives; these can significantly reduce your out-of-pocket expenses.

4. Ease of Small Transactions

For small purchases or when dealing with vendors that might not accept cards:

- Convenience: Small vendors, market stalls, or informal sellers might only accept cash, making it more accessible for quick, small transactions.

- Speed: Cash transactions are often quicker than waiting for card verification.

The Role of Receipts

Even for small transactions:

- Receipts help you maintain a record of spending, which is essential for bookkeeping, especially in a cash-heavy environment.

- They serve as proof in case of any future disagreements or for tax purposes if the purchases are business-related.

5. Avoiding Debt and Overdraft Fees

Paying with cash directly reduces the possibility of accruing debt:

- Zero Interest Rates: Unlike credit cards, cash doesn’t come with interest rates or annual fees.

- Overdraft Protection: You can’t overspend with cash, preventing overdraft fees.

Reining in Overspending with Receipts

Receipts act as a visual reminder:

- They show the accumulation of small purchases, which can add up if not monitored.

- They help in post-purchase analysis to understand spending habits and control future expenditure.

Summing Up the Benefits

Paying with cash and keeping receipts offers a unique set of advantages, from enhancing budget control to providing privacy, ensuring transaction ease, obtaining discounts, and avoiding potential debt. While digital payment methods have their perks, the tangible nature of cash and receipts provides a level of control and privacy that is hard to replicate with electronic transactions.

Understanding these benefits can help individuals make more informed decisions about their payment methods, potentially improving their financial health and privacy. The practice might seem traditional, but its benefits remain relevant in today’s digital world.

Is it better to use cash or debit cards for small transactions?

+

When dealing with small vendors or making quick purchases, cash is often more convenient. Debit cards are good when you need to track all your expenditures digitally, but for small, frequent transactions or when dealing with vendors not accepting cards, cash is preferred.

Can you track cash spending as easily as card transactions?

+

Tracking cash spending can be done manually by keeping receipts or using a budget diary. While not as automated as card transactions, with discipline, it can be tracked with similar accuracy.

How do you get cash discounts if businesses prefer cash?

+

Many businesses offer cash discounts as an incentive. Ask the merchant if there’s a cash discount, and always keep the receipt to confirm the discount received or for returns.