Payment Receipt: Your Ultimate Guide to Financial Clarity

Understanding the Basics of Payment Receipts

In today's fast-paced digital world, managing finances effectively is crucial for both individuals and businesses. One of the most fundamental aspects of this management involves the use of payment receipts. A payment receipt serves as a formal acknowledgment of payment between two parties, providing clarity and documentation essential for financial tracking and auditing.

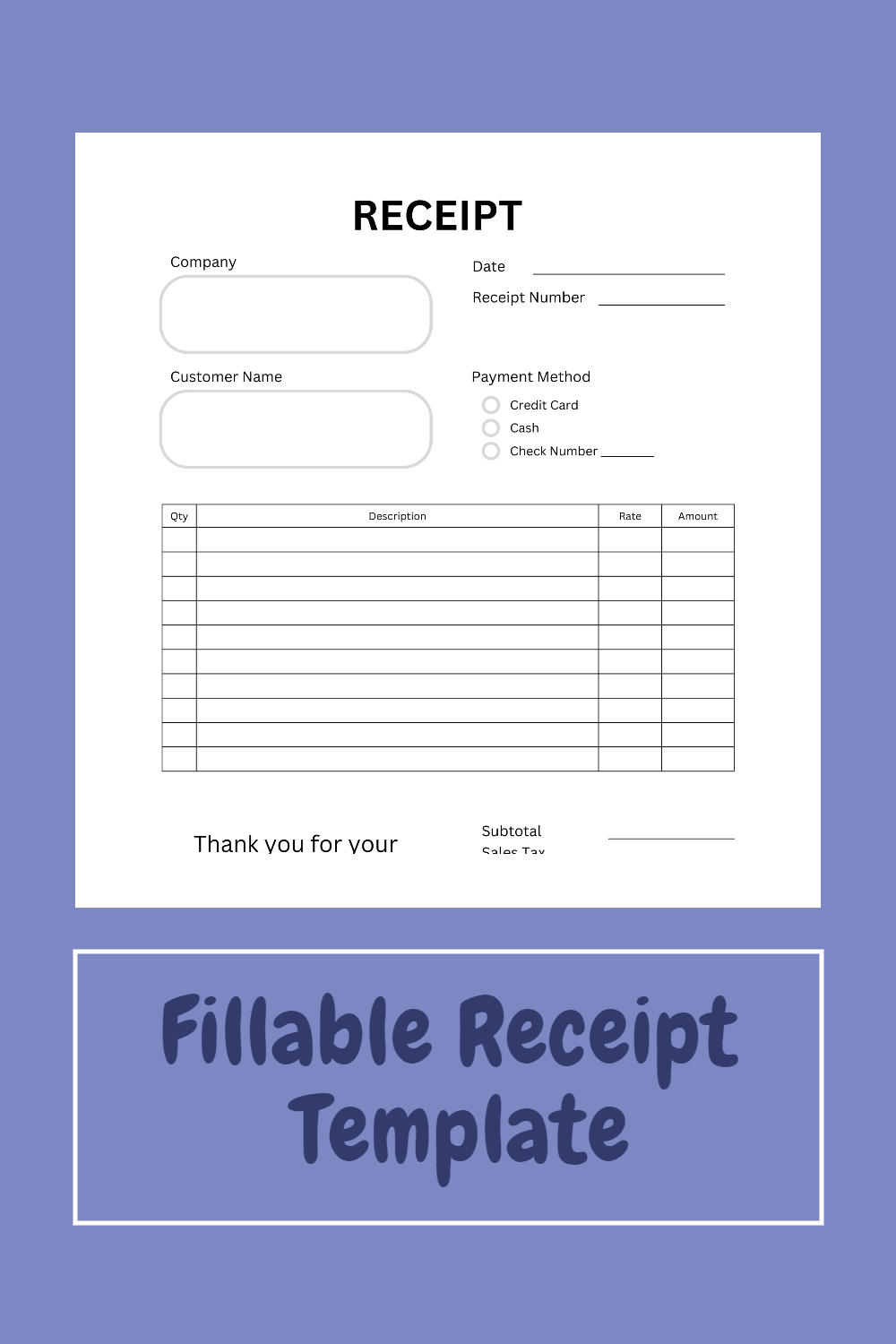

A receipt typically includes details such as:

- Date of Transaction: When the payment was made.

- Amount Paid: The monetary amount exchanged.

- Parties Involved: Details of the payer and payee.

- Description of Payment: What the payment was for.

- Method of Payment: Whether it was cash, check, credit card, etc.

Understanding the structure and importance of receipts is the first step toward maintaining financial clarity.

The Importance of Accurate Receipts

Receipts play a pivotal role in several areas:

- Tax Compliance: Receipts are often required as proof of expenditure during tax filings to validate claims for deductions or credits.

- Dispute Resolution: They serve as evidence in case of disputes or discrepancies over transactions.

- Financial Tracking: They provide a verifiable record for accounting purposes, helping to track income and expenditure.

Tax Compliance

💡 Note: Always keep your receipts organized for easy retrieval during tax season.

Dispute Resolution

In the event of a dispute:

- A receipt proves that payment was made, reducing the chance of being asked to pay again.

- It can help clarify the terms of the transaction, including what was purchased, the quantity, and any special conditions.

📝 Note: Digital receipts are becoming increasingly important as businesses move towards paperless environments.

Financial Tracking

Accurate receipts facilitate:

- Easy reconciliation of bank statements with actual expenses and income.

- Better budgeting by providing a clear picture of where money is being spent.

- Verification of cash flows, which is crucial for small businesses and startups.

How to Generate Payment Receipts

Creating a receipt can be done in several ways:

Manual Receipt Writing

- Handwritten receipts for small transactions or informal settings.

- Pre-printed receipt books for businesses, where details are filled in at the point of sale.

Using Software Tools

Modern solutions include:

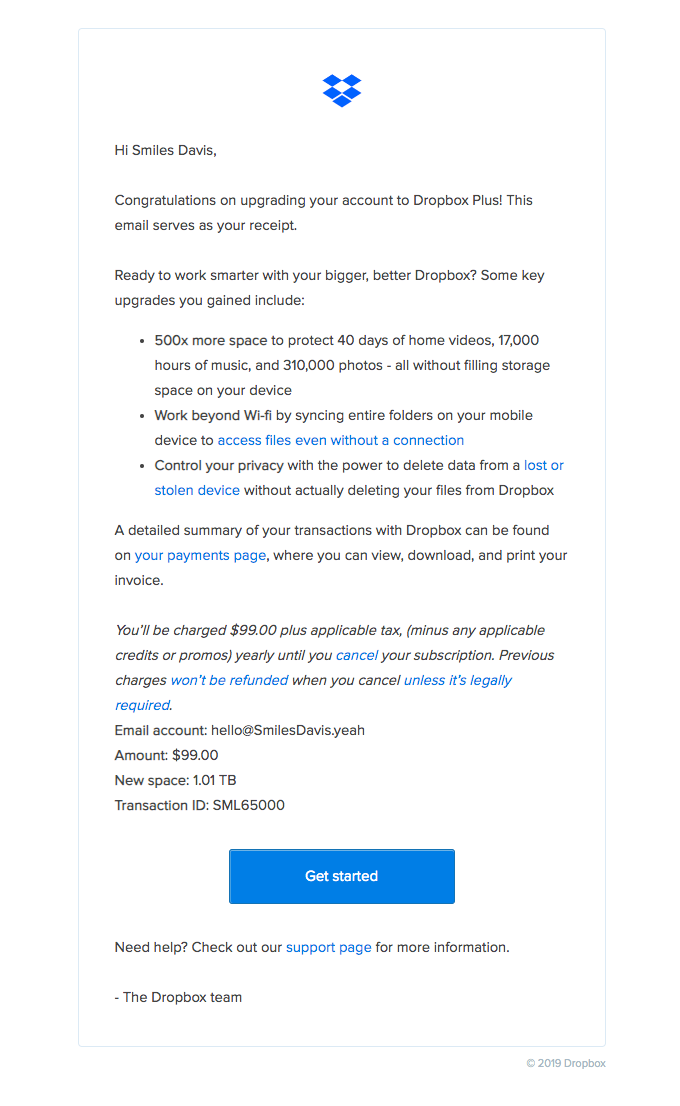

- Invoicing Software: Tools like FreshBooks or Zoho Invoice generate receipts automatically after an invoice is marked as paid.

- Point of Sale (POS) Systems: These issue receipts at the time of sale and often integrate with accounting software.

Online Receipt Generators

There are also numerous websites and mobile apps designed specifically for generating professional-looking receipts:

- Rocket Receipt: A simple tool for generating custom receipts.

- Receipt Generator: Offers templates that can be tailored to specific business needs.

📱 Note: Always ensure you back up your digital receipts; cloud storage or external hard drives can be used.

Best Practices for Managing Receipts

Here are some tips to streamline the process:

Organize Regularly

- Use physical or digital folders to categorize receipts by date, vendor, or expense type.

- Regularly update your records to prevent accumulation and confusion.

Backup Digital Records

- Use cloud services like Google Drive, Dropbox, or OneDrive.

- Consider using accounting software with built-in backup features.

Retain Receipts

Retain physical and digital receipts for the statutory period mandated by tax authorities:

- Many countries require businesses to keep receipts for a minimum of 5 years.

Scan and Digitize

- Use scanners or apps like CamScanner to create digital copies of paper receipts.

🌟 Note: Implement a routine for reviewing and reconciling receipts to catch errors or discrepancies early.

Summary

The importance of payment receipts cannot be overstated in financial management. They provide a clear, documented record of financial transactions, which is essential for dispute resolution, tax compliance, and overall financial tracking. Whether you’re a business owner or an individual, understanding how to create, manage, and retain receipts can significantly enhance your financial clarity and control.

How long should I keep my receipts?

+

Keep receipts for the statutory period required by tax laws, which is typically 5 years. However, for certain long-term investments or purchases, consider retaining them for longer.

Can I use digital receipts for tax purposes?

+

Yes, many tax authorities now accept digital receipts as long as they are clear, complete, and verifiable.

What should I do if I lose a receipt?

+

Contact the vendor or seller for a duplicate receipt or statement. If that’s not possible, recreate the transaction details using your financial records or bank statements.