Unveiling MPI: Secure Code Verification for Transactions

Introduction to Secure Code Verification

Secure code verification is a critical aspect of modern financial transactions. It serves as a shield, guarding against unauthorized access and fraudulent activities by verifying the authenticity of both the transaction codes and the users involved. This method ensures not only the integrity of financial transactions but also fortifies the trust in the system. In this blog, we’ll delve into the intricacies of secure code verification, focusing on MPI (Merchant Plug-in), its importance, and its operational framework.

Understanding MPI

MPI stands for Merchant Plug-in, a software component that aids in the authentication process during online transactions. Here’s what you need to know:

- MPI acts as a liaison between merchants and the card issuer’s authentication system.

- It checks if the transaction qualifies for 3D Secure protocols like Verified by Visa or MasterCard SecureCode.

- MPI verifies the user’s identity through a second factor of authentication, ensuring secure transactions.

The Process of Secure Code Verification

Let’s look at how MPI functions within the secure code verification framework:

- Transaction Initiation: The consumer selects an item or service, proceeds to payment, and enters their card details.

- MPI Check: The transaction information is passed to MPI, which checks for compliance with 3D Secure protocols.

- Authentication:

- Low-risk transactions might bypass this step.

- High-risk transactions require an additional step where the card issuer sends an ACS (Access Control Server) URL to the MPI.

- The consumer is redirected to the issuer’s authentication page to verify their identity.

- ACS Response: The ACS confirms or rejects the authentication. The MPI sends this result back to the merchant.

- Transaction Completion: If authentication is successful, the transaction proceeds; if not, it is halted or redirected to alternative payment methods.

💡 Note: The specific steps can vary based on the payment gateway’s implementation of MPI and 3D Secure.

Benefits of Secure Code Verification

- Enhanced Security: Provides an additional layer of security, reducing fraud risk.

- Compliance: Adheres to 3D Secure standards, necessary for PCI DSS compliance.

- Liability Shift: Moves the liability of fraudulent transactions to the card issuer upon successful authentication.

- Consumer Confidence: Increases trust in online shopping by ensuring transaction security.

Challenges and Considerations

Despite its advantages, secure code verification through MPI has its challenges:

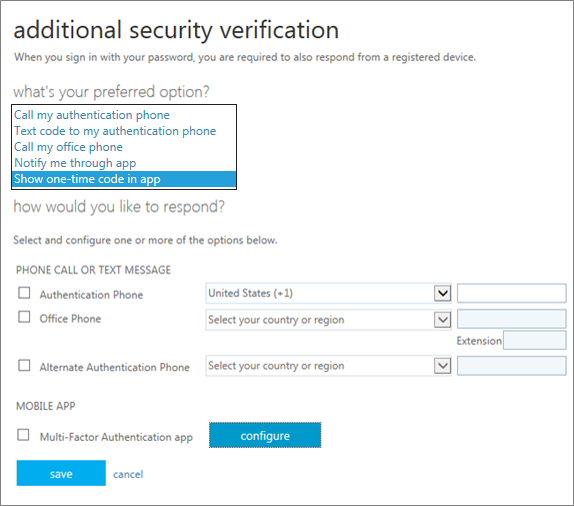

- User Experience: Additional authentication steps might inconvenience the user.

- Integration: Requires merchants to integrate MPI into their payment processing system.

- Cost: There might be costs associated with MPI licensing and maintenance.

- Compatibility: Ensuring compatibility with various banks and payment gateways can be complex.

Future of MPI and Secure Code Verification

The evolution of secure code verification is pivotal as digital transactions grow:

- EMV 3DS: A new version of 3D Secure designed to reduce friction in authentication.

- Biometric Authentication: Fingerprints or facial recognition could become commonplace, enhancing security.

- Behavioral Analysis: AI and machine learning will help predict and prevent fraud through pattern recognition.

- Decentralization: Blockchain could offer a new layer of verification and auditability.

As we explore the realms of secure code verification and MPI, we find a world where security and convenience can work in harmony. Transactions are not only protected but also efficient and user-friendly. While challenges exist, the future promises even more robust systems, potentially incorporating emerging technologies to stay ahead of fraudsters.

What is the primary function of MPI in secure transactions?

+

MPI, or Merchant Plug-in, facilitates the secure code verification process by checking if a transaction qualifies for 3D Secure authentication, and it communicates with the card issuer’s Access Control Server (ACS) to validate user identity.

How does MPI affect the user experience in online shopping?

+

While MPI adds an additional layer of security, it might introduce minor friction in the payment process due to the extra authentication step, potentially impacting the user experience. However, the benefits in security often outweigh this slight inconvenience.

Can MPI be used with all types of payment cards?

+

MPI primarily works with credit and debit cards that support 3D Secure protocols such as Visa, MasterCard, and American Express. The availability of MPI for other card types or non-card payment methods might vary.