What to Do When You Lose a Receipt: Estimate Costs Easily

Understanding the steps to take when you lose a receipt can save you from headaches and potential financial losses. Whether it's for a business expense, a personal purchase, or an insurance claim, lost receipts can complicate your record-keeping. This guide will help you navigate through the scenario of a missing receipt with ease and accuracy in estimating costs.

Why Receipts Matter

Before diving into what to do when you lose a receipt, it’s crucial to understand why receipts are important:

- Tax Deductions: Receipts serve as proof for tax deductions.

- Warranty Claims: Many products require the original receipt for warranty or service claims.

- Budgeting: Tracking expenses helps in managing personal or business finances.

- Insurance Claims: Lost or damaged items need to be verified through receipts for reimbursement.

Step-by-Step Guide to Estimate Costs without Receipts

1. Gather Relevant Information

The first step after you realize you’ve lost a receipt is to gather as much information as possible:

- What was purchased?

- Where and when did the purchase take place?

- Any approximate amount spent?

- Was the purchase made with a credit or debit card?

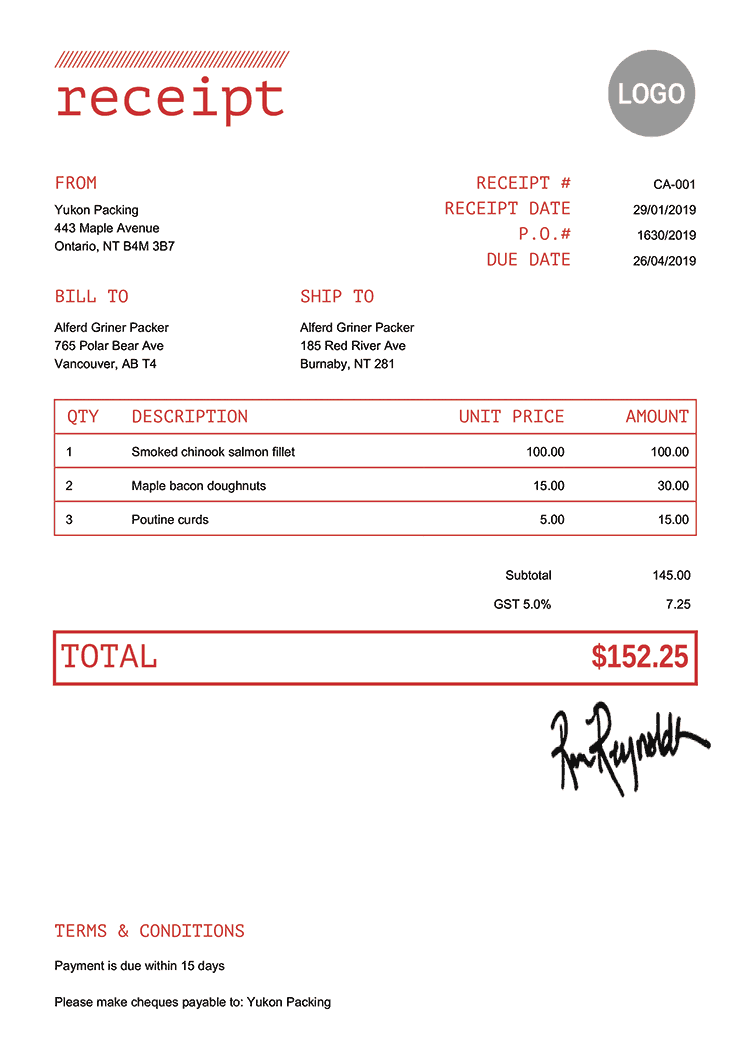

2. Check Bank or Credit Card Statements

If the purchase was made with a card, check your bank or credit card statement:

- Look for the transaction date, merchant name, and amount spent.

- Bank statements can provide enough detail to estimate costs.

💡 Note: Digital banking apps make this step quick and easy, allowing you to filter by merchant or date range.

3. Contact the Merchant

Reach out to the merchant or store:

- Provide them with as much detail as possible.

- Ask if they can find the transaction in their system and issue a duplicate receipt or a statement.

- Most businesses, especially larger ones, keep records of transactions for a reasonable period.

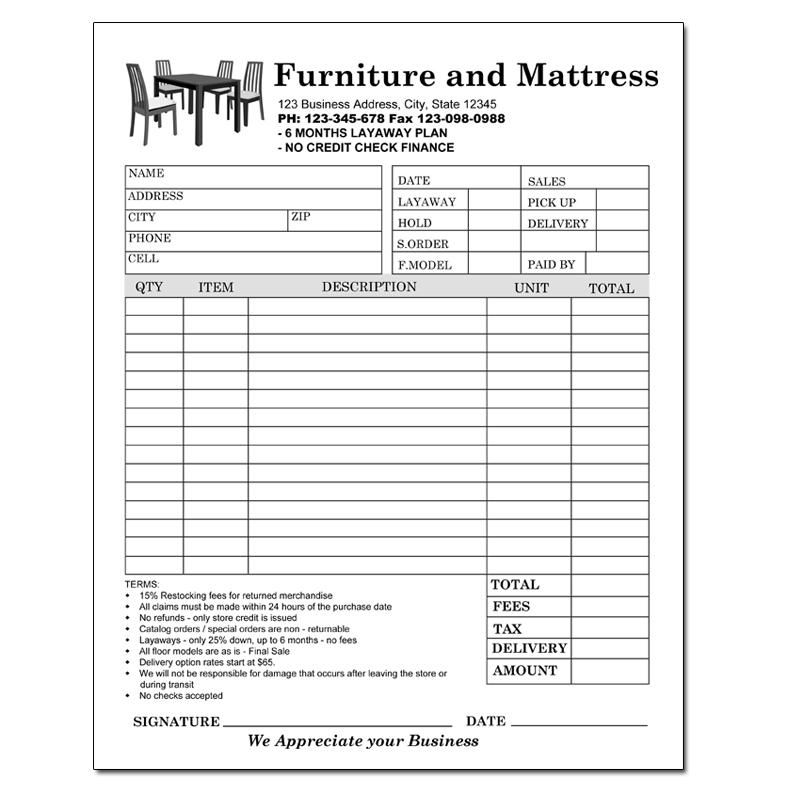

4. Look for Proof of Purchase Alternatives

If contacting the merchant fails, consider the following alternatives:

- Email confirmations or shipping receipts.

- Digital wallets or payment apps that store transaction history.

- Photos of products with serial numbers or model codes.

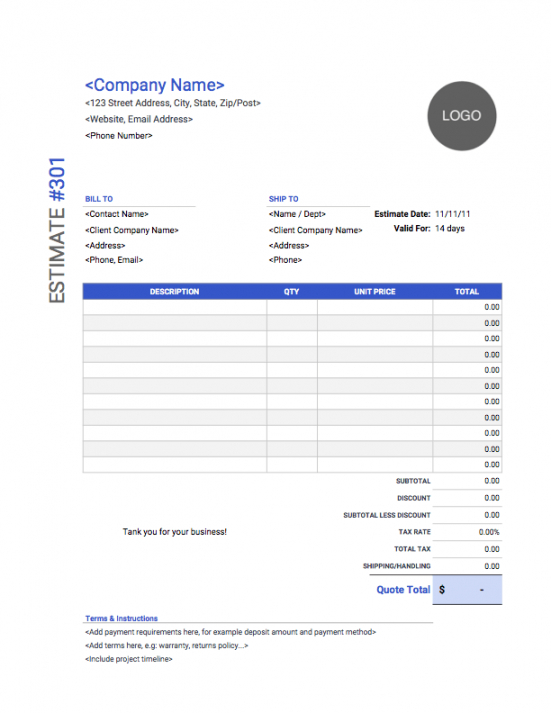

5. Estimate Costs Using Comparison Sites

If you can’t find the exact cost, here are steps to estimate the value:

- Identify the product or service.

- Visit comparison websites or search engines like Google Shopping or Amazon.

- Look for similar items in terms of brand, model, and features.

- Note current prices, considering any discounts or promotions at the time of your purchase.

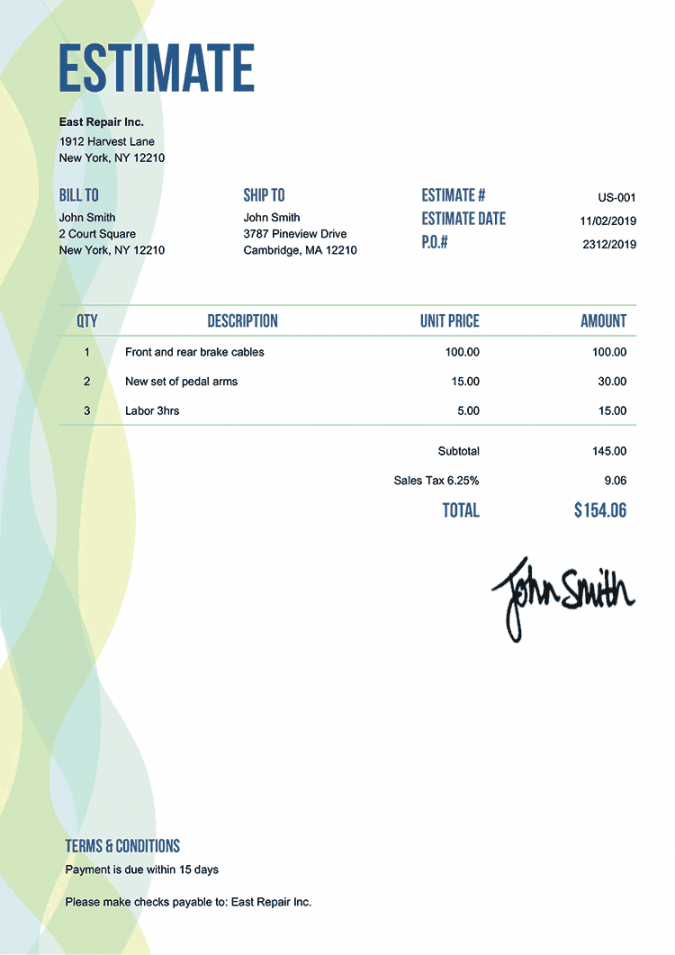

6. Document Your Efforts

Keep a record of your efforts to replace or estimate the lost receipt:

- Emails sent to merchants or customer service.

- Screenshots of attempts to recover transaction details.

- Notes on how you estimated costs.

7. Preventive Measures for the Future

To avoid the hassle of lost receipts, adopt these habits:

- Use digital receipt apps or services that store electronic copies.

- Ask for receipts to be emailed instead of printed.

- Set reminders for when receipts are needed for warranties or returns.

In conclusion, while losing a receipt can feel like a major inconvenience, with the right approach, you can estimate costs effectively. By gathering relevant information, contacting merchants, and using available tools, you can manage without the physical receipt. Implementing preventive measures will further reduce the chances of future loss. Remember, it's not just about estimating the cost of what was lost, but also maintaining a record for tax, insurance, or warranty claims.

What if I can’t find any proof of purchase at all?

+

If you can’t find any proof, try to contact customer service of the company or use online tools to estimate the cost based on similar products available currently.

Can I still get a tax deduction without a receipt?

+

Yes, but you’ll need to provide some form of proof. This might include bank statements, credit card statements, or written confirmation from the vendor.

How long should I keep my receipts?

+

It varies by purpose, but for tax purposes, receipts are generally kept for 3-7 years. For warranties, keep them for the warranty period.

What if the merchant doesn’t have the transaction on record?

+If they have no record, you might need to rely on alternative proof like bank statements or use online estimates to approximate the cost.

What are some best practices for keeping receipts?

+Best practices include scanning and digitally storing receipts, using mobile apps for receipt management, and setting up systems to categorize and track expenses.