How to Correctly Update Recipient Address on W-9 Form

Updating the recipient address on a W-9 form is a straightforward process, but it requires attention to detail to ensure accuracy and compliance with IRS regulations. Whether you're a sole proprietor, freelancer, or running a small business, making sure your W-9 form reflects your current address is crucial for tax reporting and payment purposes. Here's a step-by-step guide on how to update the recipient address correctly.

Understanding the Importance of the Recipient Address on a W-9

The W-9 form is used by payers to verify the correct Taxpayer Identification Number (TIN) for a recipient who is required to file an information return with the IRS. This includes recipients of dividends, interest, rent, and royalties, among others. The address on the W-9 must be current because:

- It helps in correctly issuing 1099 forms for tax reporting.

- It ensures that any payments or tax documents are sent to the correct location.

- It can prevent delays in processing by the IRS due to incorrect mailing information.

Steps to Update the Recipient Address

To update the recipient address on a W-9 form, follow these steps:

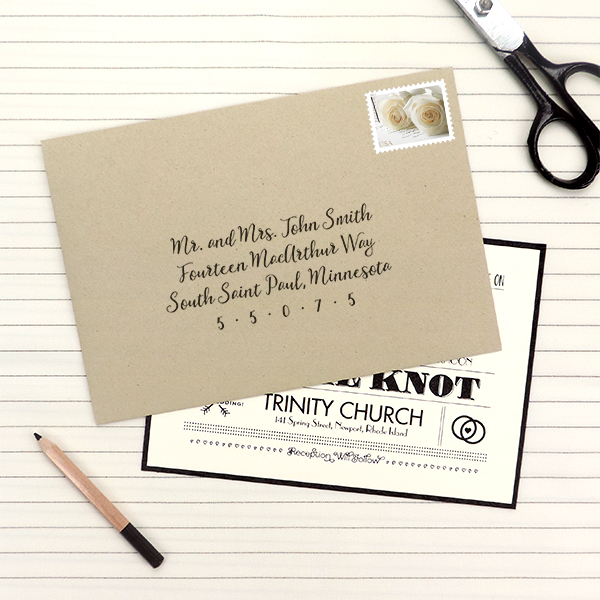

Step 1: Access a New W-9 Form

First, obtain a new or blank W-9 form from the IRS website or a reliable source. This ensures you’re working with the most current version of the form.

Step 2: Fill Out the Form

Fill out the W-9 form as you normally would:

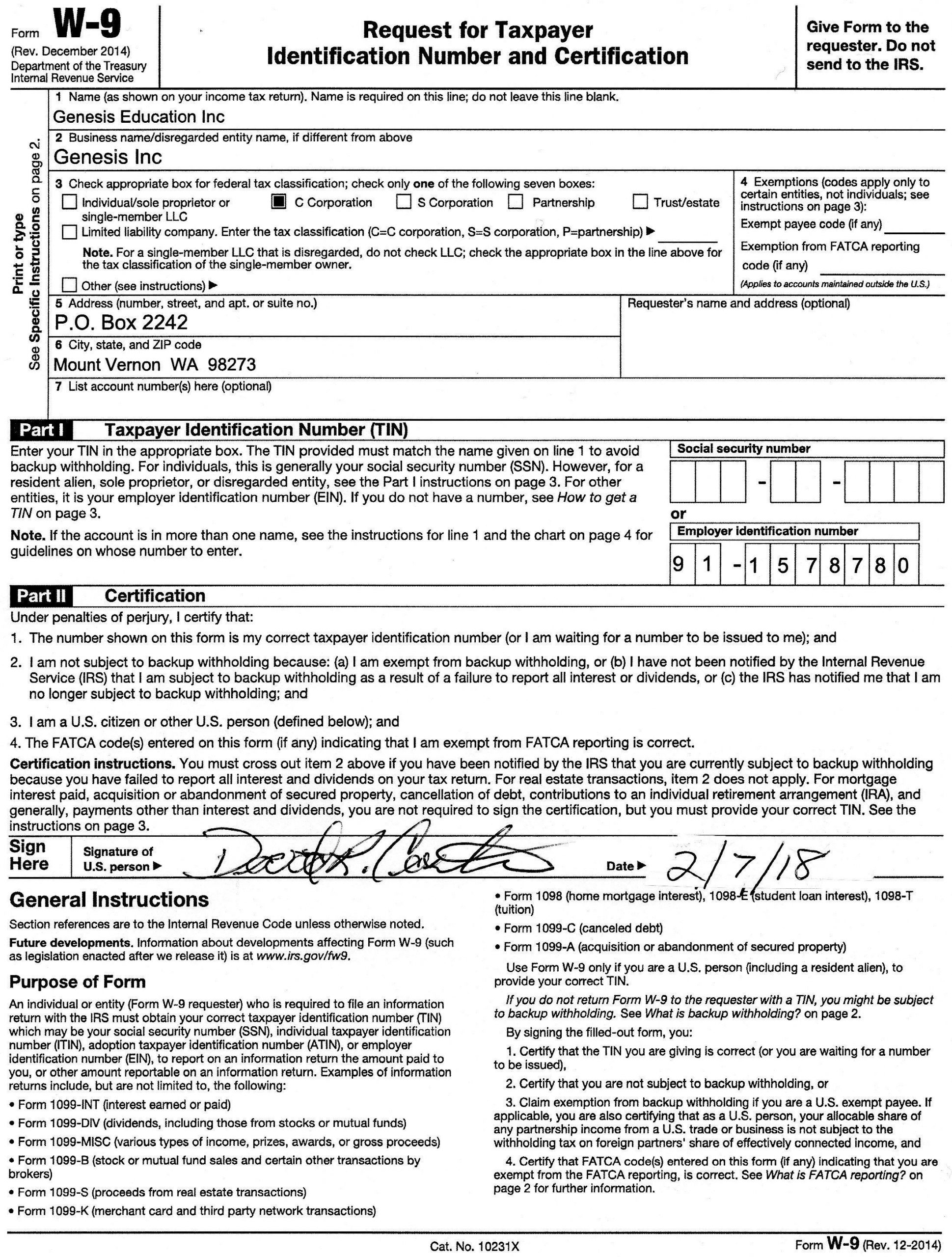

- Name (as shown on your income tax return)

- Business name (if applicable)

- Federal tax classification

- Address (This is where you will update the recipient address)

- City, state, and ZIP code

- TIN (Employer Identification Number or Social Security Number)

- Exemption code (if any)

When you reach the address section, enter your new address:

| Form Part | What to Enter |

|---|---|

| Address (number, street, and apt. or suite no.) | Write your new street address or P.O. box. |

| City, state, and ZIP code | Enter the city, state, and ZIP code for your new address. |

Step 3: Complete the Form

Finish filling out the rest of the W-9 form. Remember, other information like your TIN and legal name must remain the same unless you are also making changes to those.

Step 4: Sign and Date

Sign and date the form at the bottom. Your signature certifies that the information provided is accurate under penalty of perjury.

Step 5: Notify Your Payers

After filling out the W-9 with your updated address:

- Inform your payers about the change. This includes clients, customers, or any entity that pays you for services or products.

- Provide them with the updated form either by email, through an online portal, or by mailing the form directly to them.

📌 Note: Ensure that you update your address with the IRS as well if your mailing address for tax purposes has changed.

Additional Tips for Updating Your Address

Here are some additional tips to keep in mind:

- When filling out the W-9, use black ink and write clearly to avoid any misinterpretation.

- If you operate under a business name or DBA, ensure this information reflects your current business status.

- Always keep a copy of the updated form for your records.

- Consider informing the IRS of your address change through Form 8822 if it’s for tax purposes.

Summing It Up

Updating your recipient address on a W-9 form is not only about keeping your tax documents in order but also about ensuring that payments and other important correspondence reach you. By following the outlined steps, you can update your address correctly, thereby maintaining compliance with IRS regulations and keeping your business affairs running smoothly. Remember, the key to success here is meticulousness; any error could potentially lead to IRS scrutiny or delayed payments, so take the time to ensure all information is accurate and up-to-date.

Do I need to update my W-9 every time I change my address?

+

You should update your W-9 form whenever your address changes to ensure accurate mailing of tax documents and payments.

Can I submit an updated W-9 to multiple payers at the same time?

+

Yes, you can submit an updated W-9 to all relevant payers at once. It’s a good practice to inform all parties involved about the address change.

What if I mistakenly provide an incorrect address on my W-9?

+

If you realize you’ve provided an incorrect address, immediately inform your payers and provide them with an updated W-9 form.