Maximize Tax Benefits with Church Donation Receipts

Are you looking for ways to reduce your tax liability while supporting worthy causes? Church donation receipts can be a powerful tool in achieving this goal. By understanding how these receipts work, what qualifies as a deductible donation, and how to maximize your contributions, you can benefit both yourself and the community at large.

Understanding Tax Deductible Donations

Church donations fall under the category of charitable contributions, which are tax-deductible if certain conditions are met. Here's what you need to know:

- Qualifying Organizations: Only donations to IRS-approved 501(c)(3) organizations are deductible. Most churches automatically qualify under this category.

- Itemized Deductions: You must itemize your deductions on your tax return to claim charitable donations. This means that your total itemized deductions must exceed the standard deduction amount to make itemizing beneficial.

- Documentation: Keep all receipts or acknowledgments from the church for each donation made. The IRS requires detailed records for all donations, especially those over $250.

What Qualifies as a Deductible Church Donation?

Here are some of the most common types of donations that can be claimed:

- Monetary Gifts: Cash, checks, or direct bank transfers.

- Non-Cash Items: Clothing, food, toys, or other tangible goods. These must be in good condition or better.

- Stock Donations: Donating appreciated stocks can provide both a tax deduction for the fair market value and avoid capital gains tax.

- Services: Although not deductible in terms of the value of time, out-of-pocket expenses related to volunteer work can be deducted.

- Property: Real estate or vehicles, subject to certain conditions.

Maximizing Your Donations

To make the most of your charitable contributions:

- Batch Your Donations: If you donate regularly, consider 'bunching' your gifts. This means making your annual donations in one tax year to surpass the standard deduction threshold.

- Donate Assets: Long-held securities or property with appreciated value can be donated to avoid capital gains tax while claiming the full fair market value as a deduction.

- Donor-Advised Funds (DAF): Use these funds to contribute assets and receive an immediate tax deduction, while deciding later where to direct the contributions.

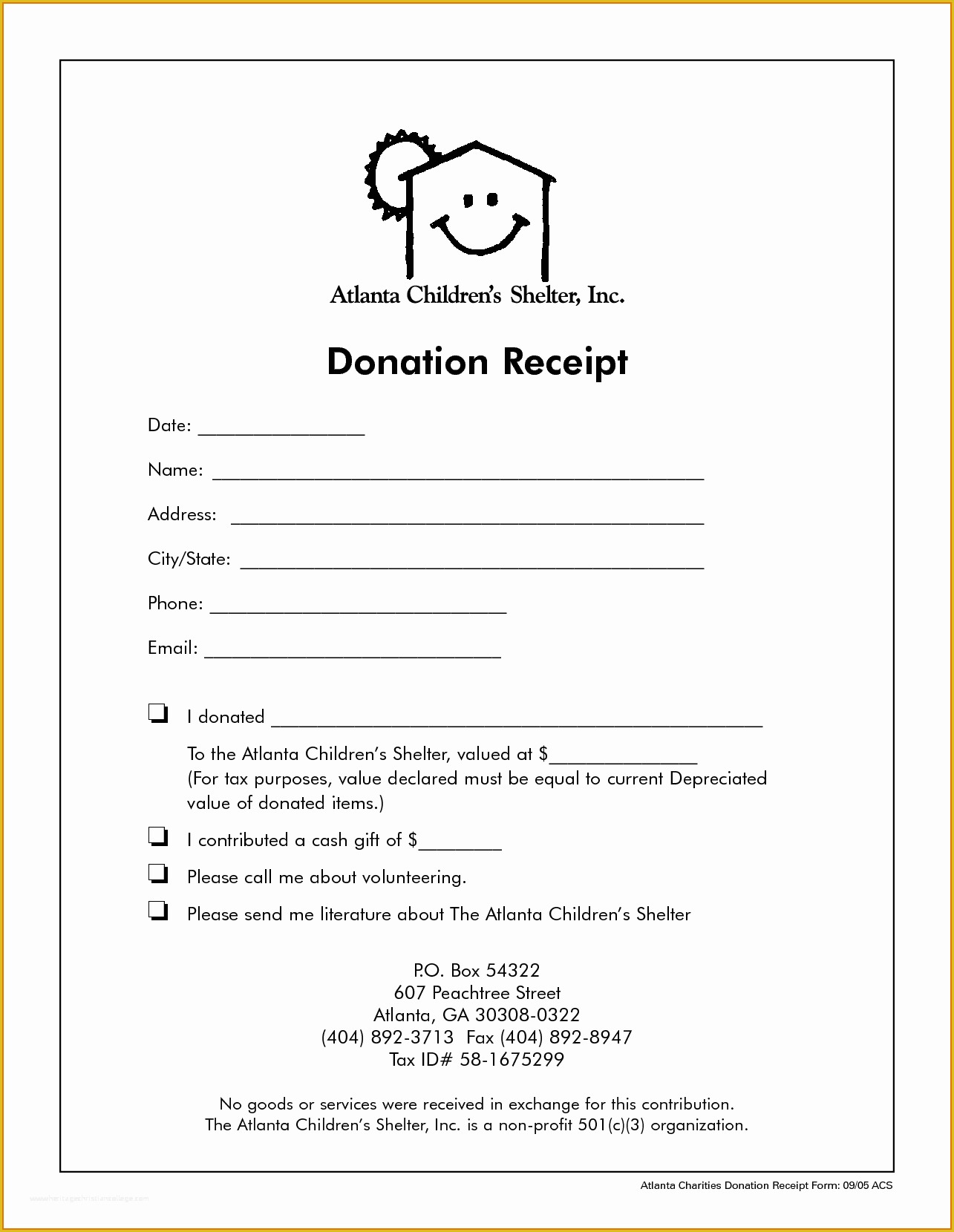

Legal Requirements for Receipts

| Donation Amount | Documentation Required |

|---|---|

| Less than $250 | Receipt or cancelled check |

| $250 or more | Written acknowledgment from the church, detailing the amount of the contribution and whether goods or services were received in exchange |

| Non-cash donations over $500 | Written documentation including item descriptions, fair market values, and acquisition costs |

| Non-cash donations over $5,000 | Professional appraisal |

📝 Note: Always obtain acknowledgment for donations of $250 or more to comply with IRS regulations.

Keeping Accurate Records

Good record-keeping is crucial for substantiating your deductions during an audit:

- Maintain receipts for each donation, including the church's acknowledgment letter.

- For non-cash items, keep a list with descriptions, values, and if available, purchase receipts.

- Use a dedicated charity folder or a digital system for organization.

Tax Planning Strategies

Here are some strategies to consider for optimizing your tax benefits through church donations:

- Qualified Charitable Distributions (QCDs): If you're over 70½, you can make direct transfers from your IRA to a church, which count towards your required minimum distributions (RMDs) without counting as taxable income.

- Charitable Trusts: Set up a trust that benefits both you (through income) and the church over time, reducing your taxable estate.

- Increase Deduction Limits: In years of exceptional need or policy changes, higher limits might be available. Keep abreast of changes in tax laws.

📊 Note: Deduction limits for charitable contributions can change, so stay informed about current tax law.

In summarizing the key points, church donation receipts are not just about giving back; they are strategic tools for tax planning. By understanding the types of donations, legal requirements, and smart strategies, you can support your church while enjoying tax benefits. It's beneficial to both you and the community you serve.

Can I claim donations to all religious institutions?

+

Only donations to IRS-approved 501©(3) organizations are tax-deductible. Most churches, temples, synagogues, and other religious organizations automatically qualify under this category. Always check the status of the institution before making a donation.

What if I donate more than I can deduct in one year?

+

You can carry over the excess for up to five subsequent tax years, provided you continue to itemize deductions.

Can I deduct the value of my time when volunteering?

+

No, the value of your time spent volunteering is not tax-deductible. However, out-of-pocket expenses related to your volunteer work, such as supplies or travel costs, can be claimed as a deduction.