5 Ways to Handle Chase Bank of America Receipts

Managing your receipts effectively is not only good for budgeting and expense tracking but also essential for tax purposes, especially if you're dealing with banks like Chase Bank or Bank of America. Here are five practical ways to handle your receipts from these institutions:

1. Digital Scanning and Organization

Traditional paper receipts can easily get lost or damaged. Here’s how you can digitally manage your receipts:

- Scan Receipts: Use a scanner or a smartphone app to scan your receipts immediately upon receiving them. Apps like Evernote or Microsoft Office Lens can scan documents with great accuracy.

- Cloud Storage: After scanning, upload the images to cloud storage solutions like Google Drive, Dropbox, or OneDrive. Label them with the date, amount, and purpose for easy retrieval.

- Organization: Create folders in your cloud storage named after months, quarters, or expense categories (like Travel, Groceries, Entertainment).

📌 Note: Always back up your cloud storage files to an external hard drive or another cloud service for added security.

2. Utilize Bank Provided Services

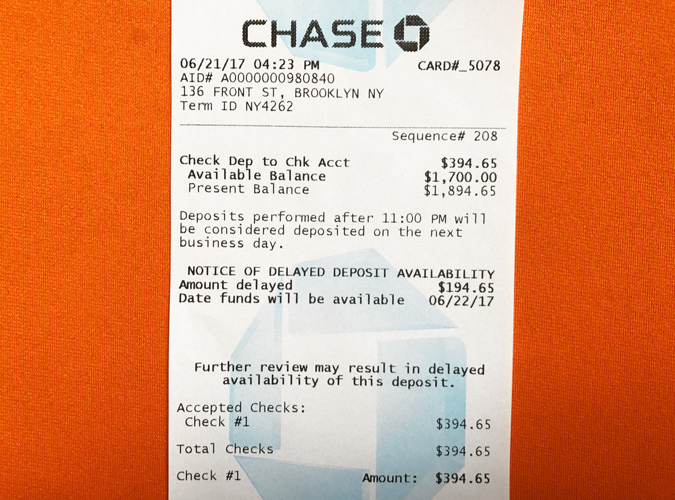

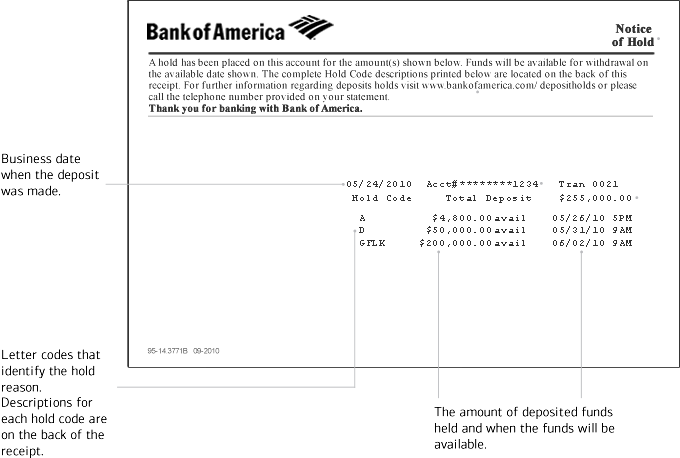

Both Chase Bank and Bank of America provide tools to manage your receipts:

- Chase QuickPay with Zelle: This service allows you to send and receive money, but you can also attach receipts for your records.

- Bank of America’s CashPro: This platform offers advanced receipt management, where you can upload and categorize receipts for business and personal transactions.

3. Automated Receipt Tracking Software

Invest in or use the following software for automated receipt tracking:

| Software | Features |

|---|---|

| Receipt Bank | - OCR technology for data extraction - Bank integration - Automatic categorization |

| Hubdoc | - Data extraction from receipts - Syncs with accounting software - Mobile app for on-the-go scanning |

| Expensify | - Multi-currency receipt management - SmartScan feature - Expense reports automation |

💡 Note: Some of these services might offer a free tier with limited features; assess your needs before subscribing to a premium plan.

4. Manual Receipts Management

For those who prefer or are comfortable with manual methods:

- Envelope System: Use envelopes labeled by month or category to store physical receipts until they are scanned or recorded.

- Ledger Book: Keep a physical ledger where you write down key details from each receipt for a tangible backup.

- File Folders: Organize your paper receipts into file folders according to categories or time periods.

5. Regular Reviews and Archiving

Don’t let your receipts pile up. Here’s how to handle them:

- Monthly Review: At the end of each month, go through your receipts. Digitize or shred those you no longer need for your records.

- Annual Archiving: Archive or shred the records from the previous year, keeping important business or tax-related receipts for the appropriate time.

🗄️ Note: Some receipts, especially for large purchases, might need to be kept for longer periods due to warranties or tax implications.

In summary, managing receipts from banks like Chase Bank and Bank of America can be streamlined through various methods. Digitization is key, but combining it with bank services, automated software, and even manual methods can ensure you never lose track of your expenses. This systematic approach not only aids in financial tracking but also significantly reduces the stress during tax season or audits.

What should I do with receipts from Chase QuickPay with Zelle?

+

You can attach receipts to transactions or simply save them in your email or cloud storage for future reference.

How long should I keep my receipts?

+

Keep them for as long as legally required for tax purposes or until you no longer need them for warranties or returns. For personal records, 7 years is a common guideline for tax purposes in the U.S.

Can I automate receipt tracking with my bank’s software?

+

While banks don’t usually provide full automation, they offer services like CashPro from Bank of America that help categorize and manage receipts more efficiently.

What if I can’t find a digital copy of a receipt?

+

Contact the store or service provider for a duplicate receipt or use a photo from your email confirmation if available.