5 Ways to Handle Cashier's Check Without a Recipient

Handling a cashier's check when there's no recipient named on the check can be somewhat tricky but manageable with the right approach. Here are five strategic ways to deal with such a situation, ensuring your funds remain secure and are directed appropriately:

1. Inquire with the Issuer

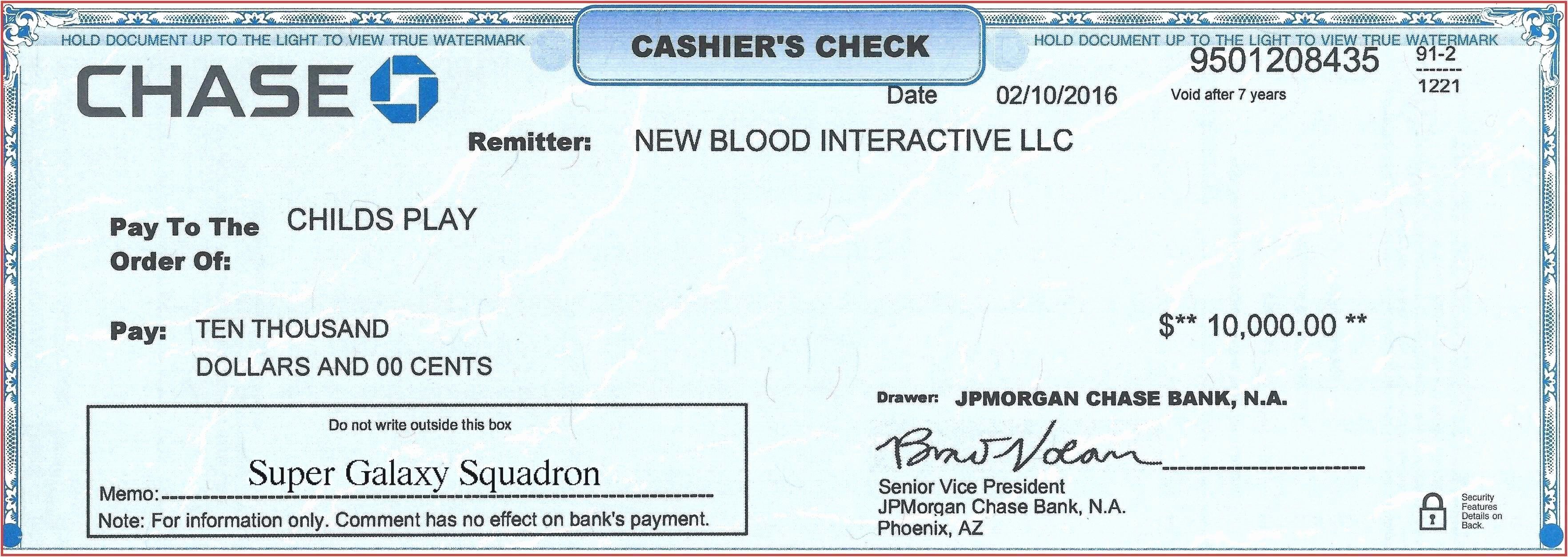

If you’ve received a cashier’s check and there’s no recipient or the details are unclear, your first step should be to contact the bank or financial institution that issued the check. Here’s how you might proceed:

- Provide Check Details: Have the check number, date of issue, and the amount ready.

- Ask for Information: Request information on how the check was issued and what steps need to be taken if the recipient is not specified.

- Verification: Ask if they can verify the check’s authenticity and how to handle its deposit or cashing.

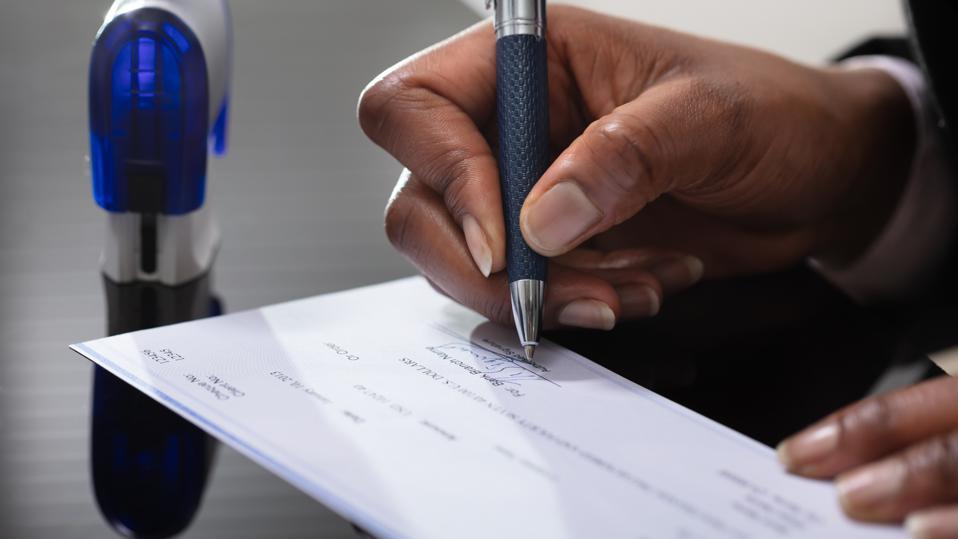

2. Endorse the Check

When you’re the payee or there’s a generic “bearer” on the check, you might need to endorse it. Here’s what you should do:

- Signature: Sign the back of the check clearly, which can be considered an endorsement if you’re the intended recipient.

- Third-Party Endorsement: If you’re transferring the check to someone else, both parties should endorse the check.

🚨 Note: Endorse the check correctly to prevent issues during the deposit or cashing process.

3. Deposit via Mobile Banking

Modern banking technology offers the convenience of depositing checks through mobile apps. Here’s how you can do it:

- Scan and Upload: Using your bank’s mobile app, photograph the front and back of the check following the app’s guidelines.

- Endorsement Mention: Include a note or endorsement statement in the memo line or on the app’s deposit form.

- Deposit Confirmation: Once the bank processes the check, ensure you receive confirmation of the deposit.

Your bank will process the check as an endorsed bearer or unnamed check, but it’s crucial to follow their specific instructions.

4. Visit Your Bank Branch

Personal visits can often expedite and clarify complex banking transactions:

- Appointment: Schedule an appointment with a bank representative.

- Present Documentation: Bring ID and any documents relevant to the issuance of the check.

- Discussion:** Talk through the situation with a banker who can guide you on depositing or cashing the check.

5. Use a Third-Party Check Cashing Service

If direct deposit or bank assistance isn’t feasible, consider using a third-party service:

- Fees: Be aware of the service fees that these companies charge.

- ID Verification: You’ll need to provide identification to use their services.

- Limits: Some services might have restrictions or limits on check amounts.

💡 Note: Check cashing services can be convenient but often come with higher fees.

Handling a cashier's check without a specified recipient involves a combination of understanding banking procedures, having the correct documentation, and sometimes, leveraging technology or third-party services. Remember to keep the check safe, as it's like handling cash. Always keep track of its whereabouts, and verify the authenticity through the issuing bank if possible. By following these steps, you can ensure the check is used efficiently and securely, even in the absence of a named payee.

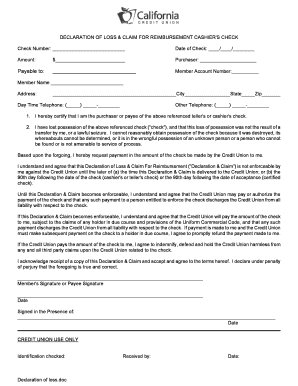

What should I do if I can’t contact the bank that issued the check?

+

Consider contacting your own bank to explain the situation. They might have access to a verification service or provide guidance on how to proceed. Alternatively, you might need to take the check to a third-party service or handle it as lost or stolen.

Can a cashier’s check be cashed at a different bank from where it was issued?

+

Yes, many banks will cash cashier’s checks if they’re verifiable, but they might impose fees or require additional verification, especially if it’s from an unfamiliar bank.

How long does it take to process a mobile deposit of a cashier’s check?

+

Mobile deposits can take anywhere from 1-5 business days for funds to become available. The exact time can vary based on the bank’s policies, the check’s amount, and its authenticity verification.