The Ultimate Guide to Cash Receipt Books

Welcome to our comprehensive guide on cash receipt books, a crucial tool for businesses of all sizes to keep track of their financial transactions. Whether you're running a small shop or a bustling enterprise, understanding the management of cash receipts is integral for maintaining financial accuracy and compliance.

What is a Cash Receipt Book?

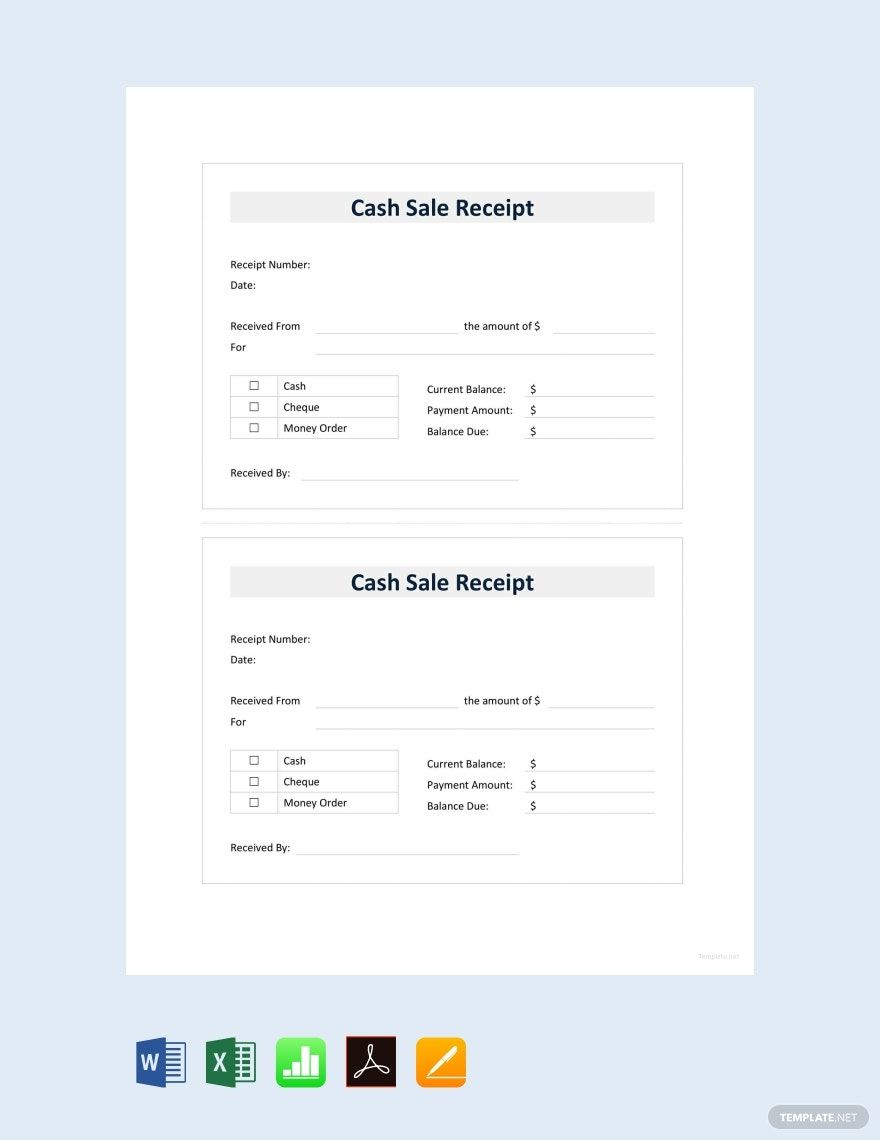

A cash receipt book is essentially a bound ledger or booklet where transactions involving cash payments are recorded. It's a system designed for documenting:

- Date of the transaction

- Receipt number

- Name of the payer

- Amount received

- Purpose of the payment

These books provide a hard copy record, which is invaluable for businesses that prefer tangible evidence of transactions for bookkeeping and auditing purposes.

Why Use a Cash Receipt Book?

Employing a cash receipt book offers several advantages:

- Transaction Tracking: Every transaction is recorded, helping in monitoring cash flow.

- Audit Trail: It creates an immediate reference for audits, tax purposes, and financial reviews.

- Legal Compliance: Recording cash receipts ensures compliance with tax laws and accounting standards.

- Dispute Resolution: It acts as evidence in case of any disputes or disagreements regarding payments.

How to Use a Cash Receipt Book Effectively

Here’s how to leverage a cash receipt book for maximum benefit:

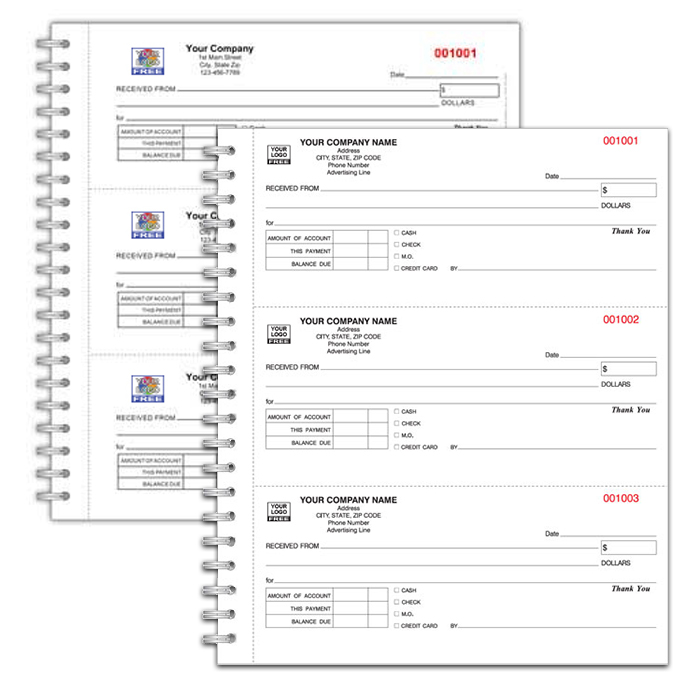

1. Date and Number Your Receipts

Ensure each receipt is dated accurately and sequentially numbered. This helps in:

- Tracking daily sales.

- Ensuring all transactions are recorded.

- Quickly identifying missing or duplicate receipts.

📅 Note: Incorrect dating can lead to confusion during audits. Always double-check the date!

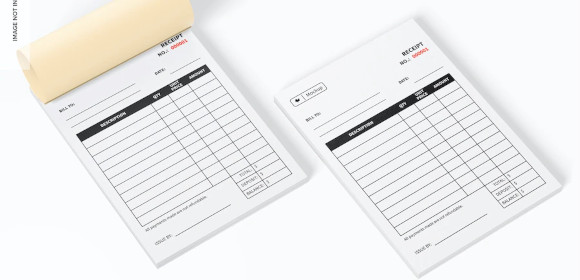

2. Record Details Thoroughly

When documenting a transaction, ensure:

- The name of the payer is clearly recorded.

- The exact amount of money received is entered.

- The purpose of payment is stated in detail.

3. Retain Copies

Most cash receipt books come with duplicate or triplicate pages. It's imperative to:

- Keep the original for the customer or the transaction log.

- Retain the duplicate for your records.

4. Regular Auditing

Set a routine for:

- Reconciling the cash in hand with the recorded receipts.

- Checking for any discrepancies or missing receipts.

- Addressing any irregularities immediately.

⚠️ Note: Regular audits prevent theft and errors, ensuring the integrity of your financial records.

5. Secure Storage

Keep your cash receipt book in a secure, accessible place to:

- Prevent theft or tampering with the records.

- Ensure records are protected from damage or loss.

Advanced Tips for Cash Receipt Management

Here are some advanced strategies:

1. Implement a Digital Backup

Consider using:

- Accounting software to scan and digitally store receipts.

- Cloud-based storage for additional security and backup.

2. Training and Protocols

Develop procedures for:

- How to handle cash receipts.

- Training staff on correct procedures.

🏅 Note: Regular training sessions can significantly reduce mistakes in cash receipt handling.

3. Batch Processing

Utilize batch processing to:

- Group and process multiple transactions at once.

- Reduce handling time and errors.

Wrapping Up

By now, you should have a clear understanding of how to use cash receipt books effectively. They serve as an essential tool for business management, providing a detailed, verifiable record of financial transactions. Accurate recording, regular audits, secure storage, and digital backups are all key practices that, when combined, ensure the integrity of your financial data. Remember, the goal is not just to keep records but to maintain them in a manner that supports business growth, financial transparency, and compliance with regulatory standards.

What should I do if I lose a receipt from my cash receipt book?

+

If a receipt is lost, immediately check the duplicate or the digital backup if available. Reissue the receipt if necessary, noting it as a replacement.

How long should I keep my cash receipt books?

+

Depending on local laws and regulations, businesses often need to retain cash receipts for at least 7 years for tax purposes.

Can I use digital receipts instead of a physical cash receipt book?

+Yes, if you maintain a secure, verifiable system that complies with financial regulations, digital receipts can replace a physical book. Ensure they are backed up regularly.

What happens if there’s a mistake on a receipt?

+If a mistake occurs, void the receipt, and issue a new one. Keep the original voided receipt for reference and reconciliation purposes.

How can I ensure my cash receipt book is not tampered with?

+Keep the book in a locked or secure location, limit access, and use tamper-evident materials where possible. Regularly audit and ensure sequential numbering to detect tampering.