Cash Receip Boock

A cash receipt book is a critical tool for tracking financial transactions and maintaining accurate records in small businesses or for personal financial management. This detailed guide explores the importance of cash receipt books, how to use them effectively, and the different types available in the market.

What is a Cash Receipt Book?

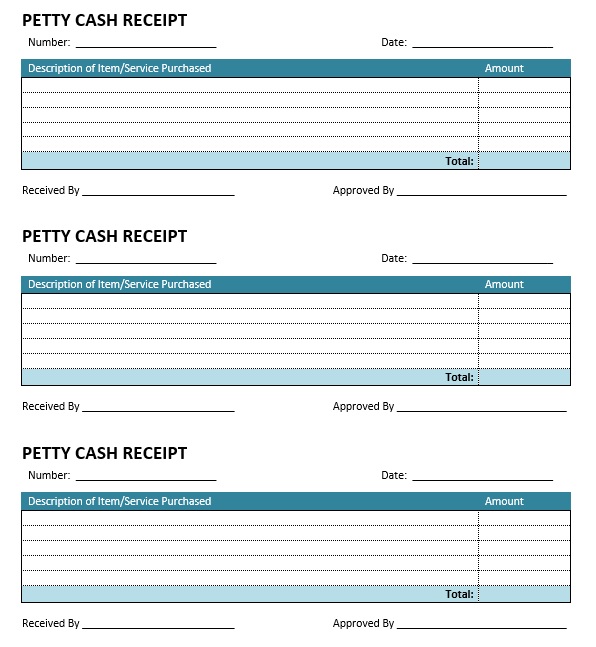

A cash receipt book is essentially a bound pad of pre-printed forms designed to record cash sales, deposits, or any monetary transaction where cash is exchanged. Each receipt in the book typically includes fields for the date of the transaction, the amount, a brief description of the transaction, and the signatures of both the payer and the receiver.

- Purpose: To document cash transactions accurately to prevent discrepancies, fraud, or disputes.

- Usefulness: Helps with tax reporting, financial auditing, and maintaining financial transparency.

Benefits of Using a Cash Receipt Book

- Record Keeping: Provides a legal document for every transaction, crucial for accounting purposes.

- Organization: Streamlines financial tracking, making it easier to manage business finances.

- Dispute Resolution: Acts as evidence in the case of any disagreements over payments or received services/products.

- Tax Purposes: Enables businesses to claim tax deductions accurately.

Types of Cash Receipt Books

Depending on the specific needs of the user, there are several types of cash receipt books:

| Type | Description |

|---|---|

| Basic Cash Receipt Book | Single copy, non-carbon copy receipt. |

| Duplicate/Triplicate Books | Carbon or carbonless copies for multiple records. |

| Carbonless Receipt Books | Easier to use than traditional carbon, avoiding smudges. |

| Customizable Books | Can be tailored to include business logos, specific fields, etc. |

| Electronic/Online Receipt Books | Digital versions for those moving away from paper. |

How to Use a Cash Receipt Book Effectively

Here are the steps to ensure you’re making the most out of your cash receipt book:

- Date the Receipt: Always start by writing the current date. This helps in maintaining a chronological order of transactions.

- Receipt Number: If your book has numbered receipts, use them sequentially to track each transaction uniquely.

- Customer Information: Record the name and address or contact details of the customer or payer.

- Description of Transaction: Briefly describe what the payment is for.

- Amount Paid: Write the amount clearly. If in multiple denominations, break it down for clarity.

- Signatures: Both parties should sign the receipt for mutual acknowledgment.

- Duplicate Copies: Ensure that copies are given to the customer and kept for your records.

- Carbonless Copies: For carbonless receipt books, ensure the pressure is enough to imprint on lower copies.

- Filing: File the receipts systematically for easy retrieval during audits or for reference.

📝 Note: Make sure to check the alignment of the carbon or carbonless copies when writing to ensure all information is transferred correctly.

When to Use an Electronic Receipt Book?

While traditional paper receipt books have their place, here are some scenarios where electronic versions might be more beneficial:

- Remote Businesses: If you frequently work away from the office, an electronic system can help sync data instantly.

- Environmentally Conscious: Reduce paper waste with digital solutions.

- Scalability: Easier to manage an increasing volume of transactions.

- Integration: Sync with accounting software for seamless financial tracking.

Transitioning from paper to electronic receipt systems requires careful planning:

- Select software that supports mobile access for on-the-go receipt creation.

- Ensure the software offers features like data encryption for security.

- Look for systems that offer automated backup and data recovery options.

Summary

In summary, managing a cash receipt book effectively involves understanding its purpose, choosing the right type for your needs, and following a systematic approach to recording transactions. Whether you opt for a traditional paper book or modern electronic solutions, the key is in maintaining accurate records for financial clarity, legal protection, and tax purposes. These practices not only help in keeping your business transactions transparent but also streamline financial management processes, making your life as a business owner or manager much easier.

Why are carbonless copies important?

+

Carbonless copies ensure that both parties (the payer and the receiver) have a record of the transaction without the need for messy carbon paper. This provides a clear, readable copy instantly, preventing issues with smudging or faded print.

Can electronic receipt books replace paper ones?

+

Yes, electronic receipt books can replace paper ones if they offer similar functionalities such as receipt numbering, customer details, and signature recording. However, consider legal acceptance and the need for physical records in some cases.

How long should businesses keep cash receipts?

+

Businesses should retain cash receipts for at least seven years to comply with most tax regulations and to prepare for audits or legal scrutiny.