Executor of Will Receives 1.2 Estate Share

When it comes to estate planning, many people might only think of drafting a will. However, the intricacies of what happens after one passes away often remain shrouded in mystery. One such intricate detail is the concept of the executor receiving an estate share. Here, we'll dive deep into understanding the executor's role, how they can legally receive a share of the estate, and why this matters.

Who is the Executor of a Will?

The executor of a will is a person or entity appointed to carry out the instructions of a deceased person as outlined in their will. This role can be highly significant, as it involves managing the estate's assets, paying off debts, and distributing remaining property as per the will's instructions.

- Appointment: Typically, the deceased person selects their executor, although courts can appoint one if necessary.

- Responsibilities:

- Filing the will with the probate court

- Inventorying the deceased's property

- Paying debts and taxes

- Distributing assets according to the will

Understanding the Executor’s Share

The notion of an executor receiving a share of the estate might be confusing or surprising to some. Here’s a breakdown:

- Statutory Commission: In some jurisdictions, executors are entitled by law to receive compensation for their work. This is often a percentage of the estate value or a set fee.

- Bequests: The executor can also be named as a beneficiary in the will itself, either directly or through mechanisms like specific gifts or a residuary bequest.

| State | Executor's Compensation Rate |

|---|---|

| New York | 5% of the first $100,000, then decreasing rates |

| California | 4% on the first $100,000, then 3% on the next $100,000 |

📝 Note: Laws regarding executor compensation can vary significantly by state or country, so always consult local statutes.

Why Would an Executor Receive an Estate Share?

- As Compensation: Executing a will is not an easy task, especially for estates with complex assets. The share can serve as a form of payment for their efforts.

- Fairness: If the executor was close to the deceased, this could be a way to ensure they aren’t left out of the inheritance.

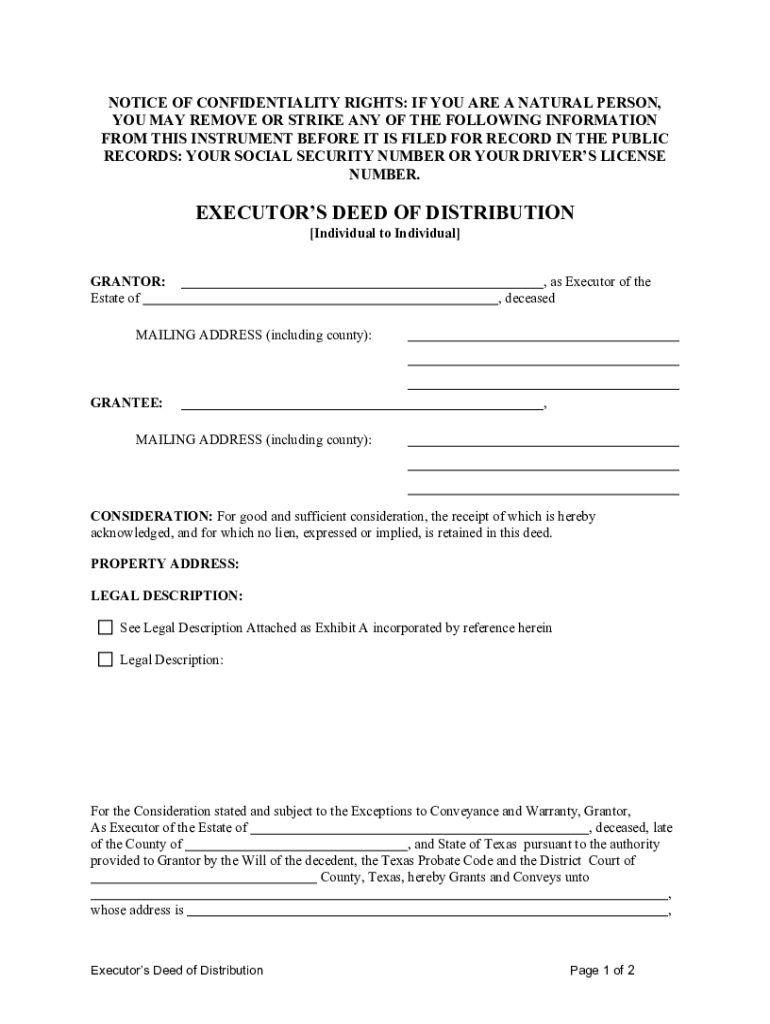

Steps to Ensure Proper Distribution

- Probate Process: The executor must file the will and get it approved in court.

- Notify Beneficiaries: All parties mentioned in the will should be notified.

- Calculate the Estate: Determine the total value after accounting for debts, taxes, and costs.

- Distribution: After settling all obligations, distribute assets as per the will. If the executor receives a share, it should be accounted for during this phase.

💡 Note: Always ensure transparency in the probate process to avoid disputes or accusations of mismanagement.

Challenges and Considerations

- Conflict of Interest: When the executor is also a beneficiary, it can lead to potential conflicts.

- Legal Requirements: Some jurisdictions might not allow executors to receive benefits unless explicitly stated in the will or permitted by law.

- Taxes: Executor compensation might be taxable, affecting the estate distribution.

Navigating Estate Law

- Seek Legal Advice: Legal counsel can help navigate the complexities of estate law, particularly around executor compensation and conflicts of interest.

- Family Dynamics: Estate planning can be an emotional process, and an executor receiving a share might be contentious, requiring tact and diplomacy.

In closing, understanding how an executor of a will can receive a share of an estate provides a clearer picture of the responsibilities and potential benefits of this role. Whether through legal commission or as a beneficiary, the executor's role is crucial in ensuring that the deceased’s wishes are honored, debts are paid, and assets are distributed fairly. This intricate balance ensures that the will remains not just a legal document, but a final statement of care and consideration towards those left behind.

Can an executor be a beneficiary in the will?

+

Yes, an executor can also be a beneficiary. This is common and doesn’t always lead to conflicts if handled transparently and legally.

What happens if the executor doesn’t properly manage the estate?

+

Beneficiaries can file a complaint with the probate court. The court might then appoint a different executor or take other legal actions.

How is executor compensation determined?

+

Executor compensation can be based on state laws, as a percentage of the estate, a set fee, or as specifically outlined in the will.

Can the executor be removed if disputes arise?

+

Yes, under certain conditions like mismanagement or fraud, the court can remove an executor and appoint someone else.