Business Date on Receipt: What Does It Mean?

When shopping at physical stores, there's a plethora of details printed on the paper receipt given at the checkout counter that the average consumer might not pay much attention to. One piece of information often taken for granted is the Business Date on the receipt. This seemingly minute detail plays an important role in various aspects of retail business operations, inventory tracking, and accounting. Let's delve into what the business date on a receipt signifies and why it's more than just another time stamp.

Understanding the Business Date

The Business Date refers to the date when the transaction was processed by the business’s internal systems. This might differ from the calendar date if the transaction occurred on a holiday, during the closure of business hours, or when the system’s date is set to reflect the operational business day:

- If a store closes at 9 pm, any purchases made after that might be recorded for the next business day.

- Transactions made on a Sunday might be processed with the Monday business date, especially if the store’s main administrative tasks are carried out on weekdays.

💡 Note: The business date is not to be confused with the transaction date, which is when the purchase occurred in real time.

Why Business Date Matters

The business date on a receipt is crucial for several reasons:

- Inventory Management: Accurate tracking of when items were sold, helps manage inventory levels more effectively. Knowing the precise day, even if it’s shifted, ensures that stock replenishment orders are timely.

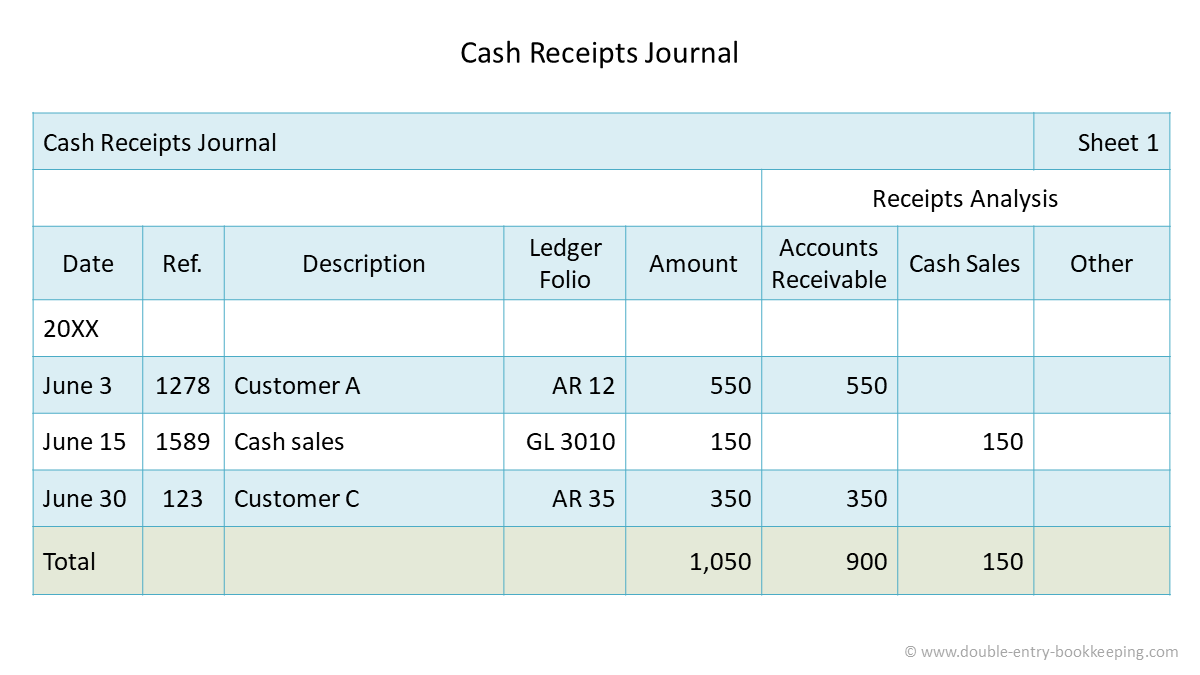

- Sales Reporting: Retailers compile their sales data for internal reporting, forecasting, and analysis. The business date helps in aligning these reports with fiscal periods accurately.

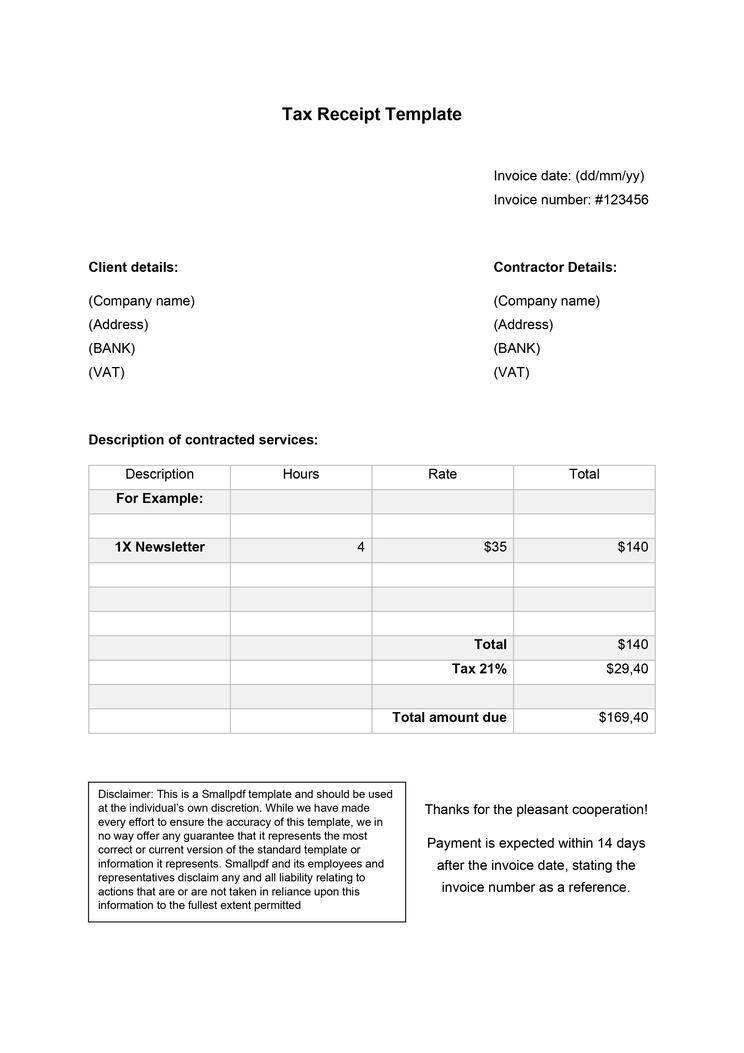

- Accounting: Bookkeepers need to know when revenues were earned, especially at the end of accounting periods or fiscal years. The business date provides clarity on when the revenue is recognized.

- Customer Service: Should there be an issue with a purchase, the business date aids in determining the validity of returns or exchanges within the store’s policy.

Business Date vs. Transaction Date

It’s important to distinguish between the business date and the transaction date:

| Feature | Business Date | Transaction Date |

|---|---|---|

| Description | Date when the transaction was processed by the business system | Actual date and time when the purchase was made |

| Use | Inventory control, accounting, sales reporting | Customer receipts, transaction logs |

How Retailers Use the Business Date

Let’s examine how businesses employ the concept of business date:

- Scheduling Staff: Knowing which days are the busiest can help in planning staff schedules to ensure optimal coverage, especially for closing or opening shifts.

- Sales Patterns: By aligning sales data with business dates, retailers can spot patterns or trends tied to specific business days, helping to inform future strategies.

- Financial Close: At the end of financial reporting periods, understanding when transactions are recorded is crucial for closing the books accurately.

🖥️ Note: Some modern POS (Point of Sale) systems have the functionality to set the business date, which might differ from the actual date.

Legal and Operational Compliance

In some jurisdictions, the use of business dates on receipts has legal implications:

- Consumer Protection: Certain return or exchange policies might be tied to the business date, giving customers a specified time from that date to return items.

- Tax Purposes: Governments might require businesses to record the date a transaction was processed for tax reporting purposes.

The accuracy of business dates on receipts ensures compliance with both internal policies and external regulations.

Implications for Consumers

As a consumer, understanding the business date on a receipt can affect several aspects:

- Returns and Exchanges: Knowing the business date can help in managing return or exchange deadlines accurately.

- Warranty Periods: Sometimes, warranties start from the business date rather than the transaction date.

- Reimbursement and Claims: In case of disputes or issues, the business date might be used to validate the claim or process a refund.

In summary, the business date on a receipt is not merely a formality but a fundamental piece of data used in the efficient operation of retail businesses. It impacts inventory management, accounting practices, sales reporting, and customer service. While consumers might not always notice this date, it can be particularly significant when it comes to understanding policies related to returns, warranties, and tax implications. Recognizing and understanding the business date can lead to better customer experiences and smoother operations for businesses.

Can the business date differ from the transaction date?

+

Yes, the business date can differ if the transaction is processed after business hours or on a non-operational day for the store’s administrative tasks.

How does the business date affect my purchase?

+

The business date can impact the validity of return or exchange periods, warranty start dates, and can be crucial for resolving disputes or claims.

Why would a retailer need a different business date?

+

Retailers often need to align transactions with their operational calendar for inventory management, accounting purposes, and to ensure accurate financial reporting, especially at the end of fiscal periods.