Understanding Broward Local Business Tax Receipts Easily

In Florida, every county has specific regulations regarding business operations. Broward County is no exception, particularly with the requirement for businesses to obtain a Local Business Tax Receipt (LBTR). Navigating through these regulations can seem daunting, but understanding the process and significance of the LBTR is crucial for any business owner in the region. This post explores what Broward Local Business Tax Receipts are, why they matter, and how you can ensure your business is compliant.

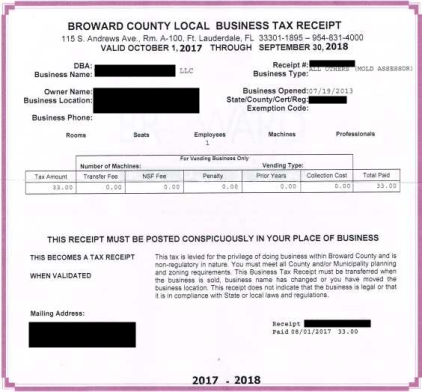

What is a Broward Local Business Tax Receipt?

The Local Business Tax Receipt (LBTR) is a license that authorizes individuals or businesses to engage in specific activities within Broward County. It’s an annual tax imposed on businesses operating within its jurisdiction, and failure to obtain this receipt can lead to penalties, fines, or even the cessation of business operations.

- Purpose: The primary aim is to provide local governments with revenue while ensuring businesses operate within the legal framework set by local ordinances.

- Coverage: The receipt applies to virtually all forms of business, from home-based businesses to multinational corporations, provided they have an office, warehouse, or any operational presence in Broward County.

Why is the LBTR Necessary?

Here are several reasons why having an LBTR is not just beneficial but mandatory for businesses:

- Legal Compliance: Businesses must be legally recognized to operate. The LBTR is proof that your business is compliant with local laws.

- Revenue Generation: The tax collected helps fund local government operations, infrastructure, and community services, which in turn benefits businesses indirectly.

- Consumer Trust: Displaying a valid LBTR can build trust with customers, as it signifies that the business is established and officially recognized.

- Business Operations: Certain permits or licenses might require proof of tax receipt, meaning you might not proceed with other business formalities without it.

How to Obtain a Local Business Tax Receipt in Broward County

Obtaining an LBTR involves several steps:

- Determine Your Business Location: Identify the specific municipality or unincorporated area in Broward County where your business will operate. Each has slight variations in requirements.

- Business Classification: Classify your business according to the North American Industry Classification System (NAICS) code to determine applicable fees.

- Registration:

Register your business with the Florida Department of State Division of Corporations, if applicable, and ensure all other state and federal licenses are in place.

🔔 Note: Certain business types like electricians or contractors might need additional licensing from state boards.

- Application Submission: Fill out the LBTR application form available online or at the local government office. Include any required documentation like proof of business location or licenses.

- Fee Payment: Pay the required fee. The cost varies based on the business size, type, and the specific area within the county.

- Receipt Issuance: Upon approval, you will receive your LBTR either by mail or electronically.

When to Renew Your Broward Local Business Tax Receipt

Renewal of LBTR typically happens annually:

- Most businesses must renew by September 30th each year to avoid penalties.

- New businesses starting after April 1st have a prorated fee for their first year.

💡 Note: Even if your business is seasonal, you still need to obtain an LBTR, but there might be options for seasonal exemptions or reduced fees.

Table: Overview of LBTR Fees in Broward County

| Business Type | Fee Range |

|---|---|

| Retail | 50 - 200 |

| Manufacturing | 150 - 500 |

| Professional Services | 30 - 120 |

The summarized key points and significance of Broward Local Business Tax Receipts ensure that businesses are not only legally compliant but also benefit from local services and community trust. Obtaining and renewing this receipt is straightforward, requiring attention to detail regarding your business type and location, ensuring compliance with all levels of governance.

What happens if I don’t obtain an LBTR?

+

Failing to obtain an LBTR can result in fines, penalties, and in some cases, closure of the business. It’s illegal to operate without this receipt.

Can I start my business before getting the LBTR?

+

No, you must have the LBTR before commencing any business activities within Broward County to be compliant with local laws.

Are there exemptions to LBTR in Broward County?

+

Yes, certain businesses like non-profit organizations, educational institutions, or government entities might be exempt. However, they still need to apply for an exemption certificate.