Wire Transfer Tips: Replace Ampersand in Recipient Names

When engaging in international transactions or business dealings, wire transfers become an indispensable tool. But amidst this convenience lies a challenge often overlooked by many: ensuring that the recipient's name is entered correctly. This post will walk you through some crucial tips for wire transfer recipients, focusing particularly on how to handle special characters like the ampersand (&) in recipient names.

Why Correct Name Entry Matters in Wire Transfers

In the world of wire transfers, precision is key. Every detail, including the recipient’s name, plays a vital role in ensuring your funds reach their destination seamlessly:

- Security: Banks use the name as part of their verification process to prevent fraud and ensure the transaction is authorized.

- Accuracy: Errors in names can lead to delays or the funds being sent to the wrong account.

- Compliance: Proper naming ensures compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

The Problem with Special Characters in Names

Characters such as the ampersand (&) can create issues during wire transfers:

- Systems might interpret special characters as commands or symbols, leading to confusion or errors.

- Many banks have policies against using special characters in names, to maintain uniformity across international transactions.

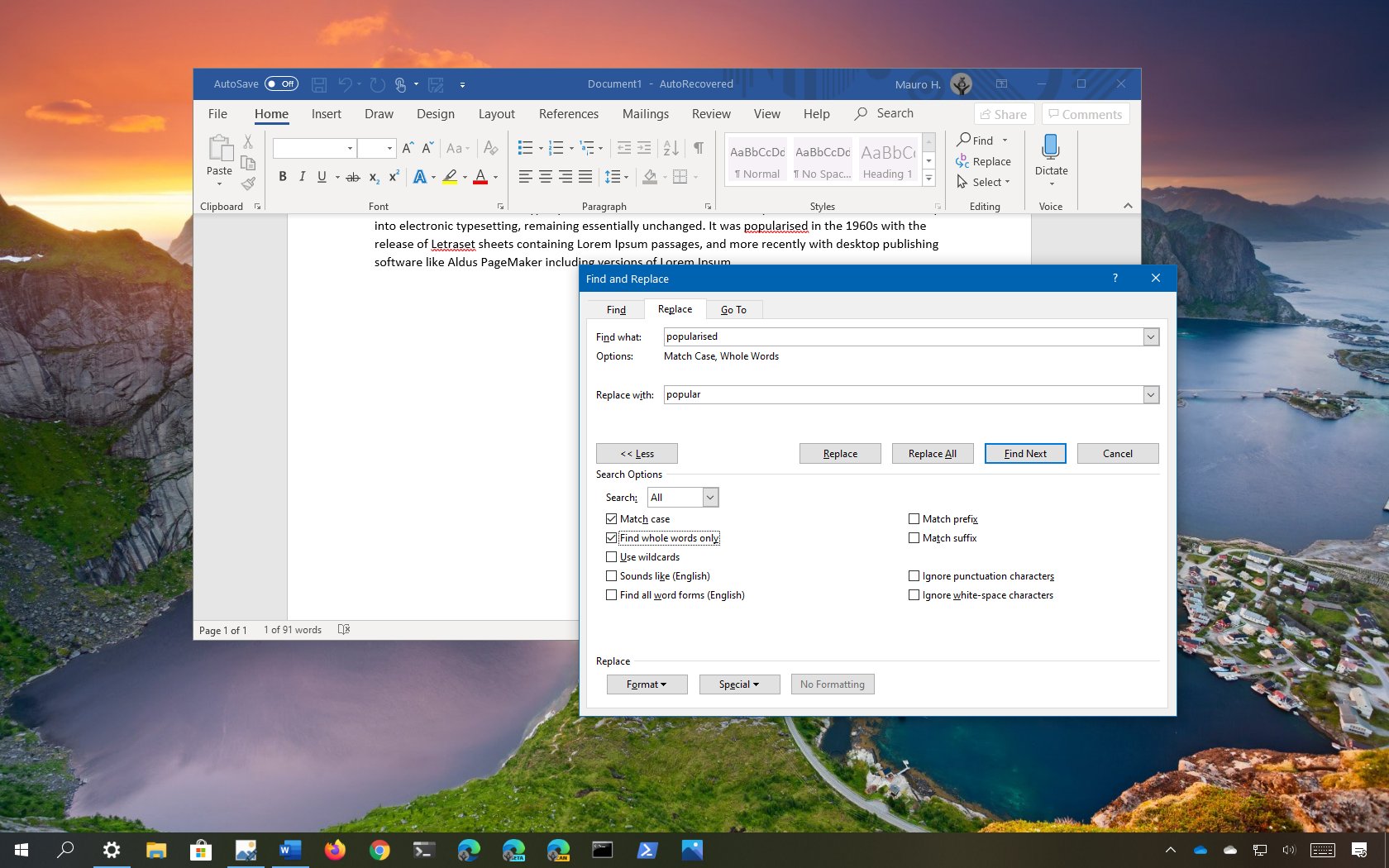

Steps to Replace Ampersands (&) in Recipient Names

Here are the recommended steps to replace the ampersand in recipient names for a successful wire transfer:

1. Identify the Issue

First, check if the recipient’s name contains an ampersand (&) or other special characters. This is particularly relevant for business names or entities that might incorporate special characters for branding or readability.

2. Replace the Ampersand with ‘and’

Replace the ampersand with the word “and”. For instance:

| Original Name | Modified Name |

|---|---|

| Smith & Johnson | Smith and Johnson |

| Blue & Co. | Blue and Co. |

💡 Note: Ensure that the modified name does not conflict with any other existing recipient in the banking system.

3. Confirm with the Recipient

It’s important to inform the recipient of the modification to prevent any confusion or potential rejection of the transaction:

- Communicate the change through email or another secure channel.

- Ask the recipient to confirm the name change.

4. Follow Bank Guidelines

Each bank might have its unique guidelines for handling special characters. Here’s what you should do:

- Check your bank’s documentation or their website for specific rules.

- If in doubt, contact your bank’s customer support for clarification.

🔍 Note: Many banks have moved to accept some special characters but it's always safer to confirm.

5. Verify Before Transfer

Double-check all details before sending the wire transfer. This includes:

- Correct and complete recipient name

- Recipient’s bank details

- Correct transaction amount

To wrap up, wire transfers are an essential method for international payments, and while managing recipient names can seem trivial, the detail is crucial. The practice of replacing the ampersand (&) with 'and' in recipient names ensures security, accuracy, and compliance, making your transactions smoother. By adhering to these guidelines, you streamline the transfer process, minimizing the chance of errors or delays. Remember, communication with the recipient and verification with your bank before initiating the transfer are your best allies in ensuring a successful wire transfer.

What should I do if the recipient’s name has special characters other than an ampersand?

+

For other special characters, follow your bank’s guidelines, which might include replacing characters with similar alphabets or simply omitting them. Always confirm with both your bank and the recipient.

Can I use symbols like # or $ in recipient names?

+

It’s best to avoid using any special characters other than letters and spaces. If unavoidable, contact your bank for specific instructions on how to handle such cases.

What happens if the recipient name is entered incorrectly?

+

An incorrect name can delay the transfer, cause the transaction to be rejected, or, in worst cases, result in the funds going to the wrong account. Always verify names before sending funds.